Alexis Akira Toda

33 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

The effect of reducible Markov modulation on tail probabilities in models of random growth

A recent economic literature deals with models of random growth in which the size (say, log-wealth) of an individual economic agent is subject to light-tailed random additive shocks over time. The d...

On Equilibrium Determinacy in Overlapping Generations Models with Money

This paper provides a detailed analysis of the local determinacy of monetary and non-monetary steady states in Tirole (1985)'s classical two-period overlapping generations model with capital and pro...

Recent Advances on Uniqueness of Competitive Equilibrium

This article reviews the recent advances in the uniqueness and multiplicity of competitive equilibria in models arising in mathematical economics, finance, macroeconomics, and trade.

Optimal taxation and the Domar-Musgrave effect

This article concerns the optimal choice of flat taxes on labor and capital income, and on consumption, in a tractable economic model. Agents manage a portfolio of bonds and physical capital while s...

Bubble Economics

This article provides a self-contained overview of the theory of rational asset price bubbles. We cover topics from basic definitions, properties, and classical results to frontier research, with an...

Unbounded Markov Dynamic Programming with Weighted Supremum Norm Perov Contractions

This paper shows the usefulness of the Perov contraction theorem, which is a generalization of the classical Banach contraction theorem, for solving Markov dynamic programming problems. When the rew...

Robust Asset-Liability Management

How should financial institutions hedge their balance sheets against interest rate risk when they have long-term assets and liabilities? Using the perspective of functional and numerical analysis, w...

Linearity of Aggregate Production Functions

We prove that when individual firms employ constant-returns-to-scale production functions, the aggregate production function defined by the maximum achievable total output given total inputs is alwa...

'Ergodicity Economics' is Pseudoscience

In a series of papers, Ole Peters and his collaborators claim that the 'conceptual basis of mainstream economic theory' is 'flawed' and that the approach they call 'ergodicity economics' gives 'reas...

Bubble Necessity Theorem

Asset price bubbles are situations where asset prices exceed the fundamental values defined by the present value of dividends. This paper presents a conceptually new perspective: the necessity of bu...

Housing Bubbles with Phase Transitions

We analyze equilibrium housing prices in an overlapping generations model with perfect housing and rental markets. The economy exhibits a two-stage phase transition: as the income of home buyers ris...

Equilibrium Selection in Pure Bubble Models by Dividend Injection

Rational pure bubble models feature multiple (and often a continuum of) equilibria, which makes model predictions and policy analyses non-robust. We show that when the interest rate in the fundament...

Leverage, Endogenous Unbalanced Growth, and Asset Price Bubbles

We present a general equilibrium macro-finance model with a positive feedback loop between capital investment and land price. As leverage is relaxed beyond a critical value, through the financial ac...

Incentivizing Hidden Types in Secretary Problem

We study a game between $N$ job applicants who incur a cost $c$ (relative to the job value) to reveal their type during interviews and an administrator who seeks to maximize the probability of hirin...

Capital and Labor Income Pareto Exponents in the United States, 1916-2019

Accurately estimating income Pareto exponents is challenging due to limitations in data availability and the applicability of statistical methods. Using tabulated summaries of incomes from tax autho...

Tuning Parameter-Free Nonparametric Density Estimation from Tabulated Summary Data

Administrative data are often easier to access as tabulated summaries than in the original format due to confidentiality concerns. Motivated by this practical feature, we propose a novel nonparametr...

Robust Comparative Statics for the Elasticity of Intertemporal Substitution

We study a general class of consumption-savings problems with recursive preferences. We characterize the sign of the consumption response to arbitrary shocks in terms of the product of two sufficien...

Fixed-k Tail Regression: New Evidence on Tax and Wealth Inequality from Forbes 400

We develop a novel fixed-k tail regression method that accommodates the unique feature in the Forbes 400 data that observations are truncated from below at the 400th largest order statistic. Applyin...

Optimal Epidemic Control in Equilibrium with Imperfect Testing and Enforcement

We analyze equilibrium behavior and optimal policy within a Susceptible-Infected-Recovered epidemic model augmented with potentially undiagnosed agents who infer their health status and a social pla...

Unbounded Dynamic Programming via the Q-Transform

We propose a new approach to solving dynamic decision problems with unbounded rewards based on the transformations used in Q-learning. In our case, the objective of the transform is to convert an un...

Tail behavior of stopped L\'evy processes with Markov modulation

This article concerns the tail probabilities of a light-tailed Markov-modulated L\'evy process stopped at a state-dependent Poisson rate. The tails are shown to decay exponentially at rates given by...

Capital and Labor Income Pareto Exponents across Time and Space

We estimate capital and labor income Pareto exponents across 475 country-year observations that span 52 countries over half a century (1967-2018). We document two stylized facts: (i) capital income ...

On the Emergence of a Power Law in the Distribution of COVID-19 Cases

The first confirmed case of Coronavirus Disease 2019 (COVID-19) in the US was reported on January 21, 2020. By the end of March, 2020, there were more than 180000 confirmed cases in the US, distribu...

Asymptotic Linearity of Consumption Functions and Computational Efficiency

We prove that the consumption functions in optimal savings problems are asymptotically linear if the marginal utility is regularly varying. We also analytically characterize the asymptotic marginal ...

Determination of Pareto exponents in economic models driven by Markov multiplicative processes

This article contains new tools for studying the shape of the stationary distribution of sizes in a dynamic economic system in which units experience random multiplicative shocks and are occasionall...

Note on Bubbles Attached to Real Assets

A rational bubble is a situation in which the asset price exceeds its fundamental value defined by the present value of dividends in a rational equilibrium model. We discuss the recent development of ...

Pareto's Limits: Improving Inequality Estimates in America, 1917 to 1965

American income inequality, generally estimated with tax data, in the 20th century is widely recognized to have followed a U-curve, though debates persist over the extent of this curve, specifically r...

Rational Bubbles: A Clarification

"Rational bubble", as introduced by the famous paper on money by Samuelson (1958), means speculation backed by nothing. The large subsequent rational bubble literature has identified attaching bubbles...

Bursting Bubbles in a Macroeconomic Model

This paper identifies the conditions and mechanisms that give rise to stochastic bubbles that are expected to collapse. To illustrate the essence of the emergence of stochastic bubbles, we first prese...

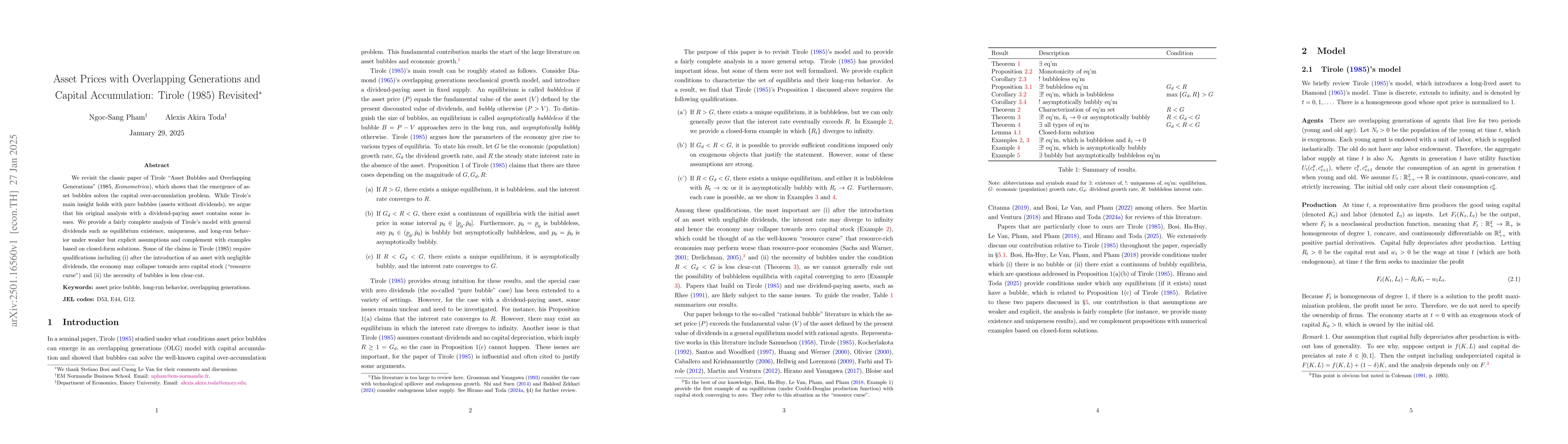

Asset Prices with Overlapping Generations and Capital Accumulation: Tirole (1985) Revisited

We revisit the classic paper of Tirole "Asset Bubbles and Overlapping Generations" (1985, Econometrica), which shows that the emergence of asset bubbles solves the capital over-accumulation problem. W...

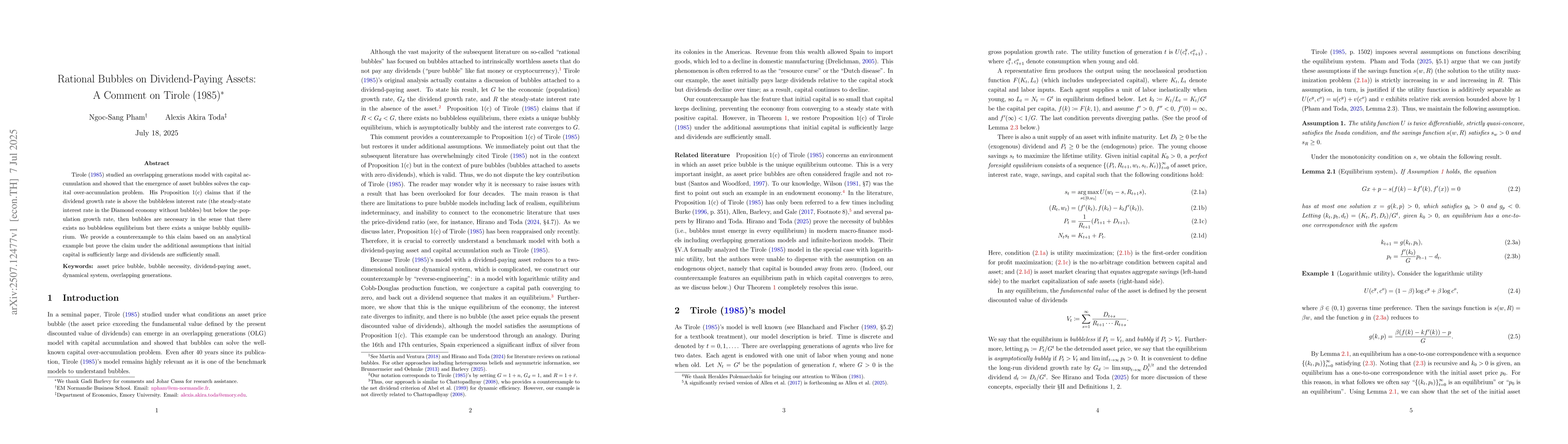

Rational Bubbles on Dividend-Paying Assets: A Comment on Tirole (1985)

Tirole (1985) studied an overlapping generations model with capital accumulation and showed that the emergence of asset bubbles solves the capital over-accumulation problem. His Proposition 1(c) claim...

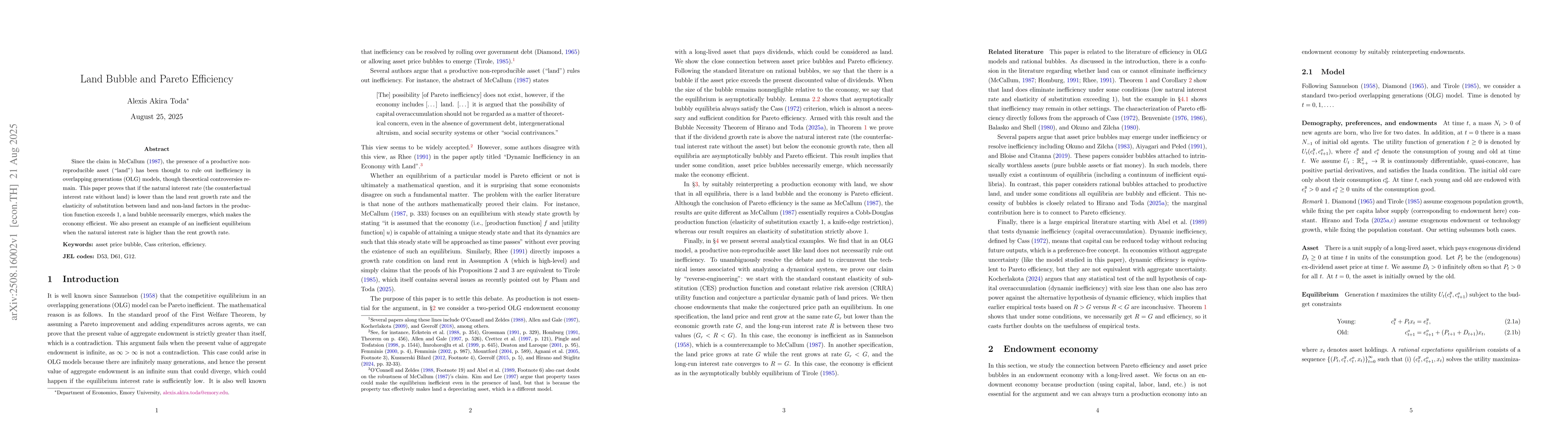

Land Bubble and Pareto Efficiency

Since McCallum (1987), the presence of a productive non-reproducible asset ("land") has been thought to rule out inefficiency in overlapping generations (OLG) models, though theoretical controversies ...

Optimal Savings with Preference for Wealth

The consumption function maps current wealth and the exogenous state to current consumption. We prove the existence and uniqueness of a consumption function when the agent has a preference for wealth....