Summary

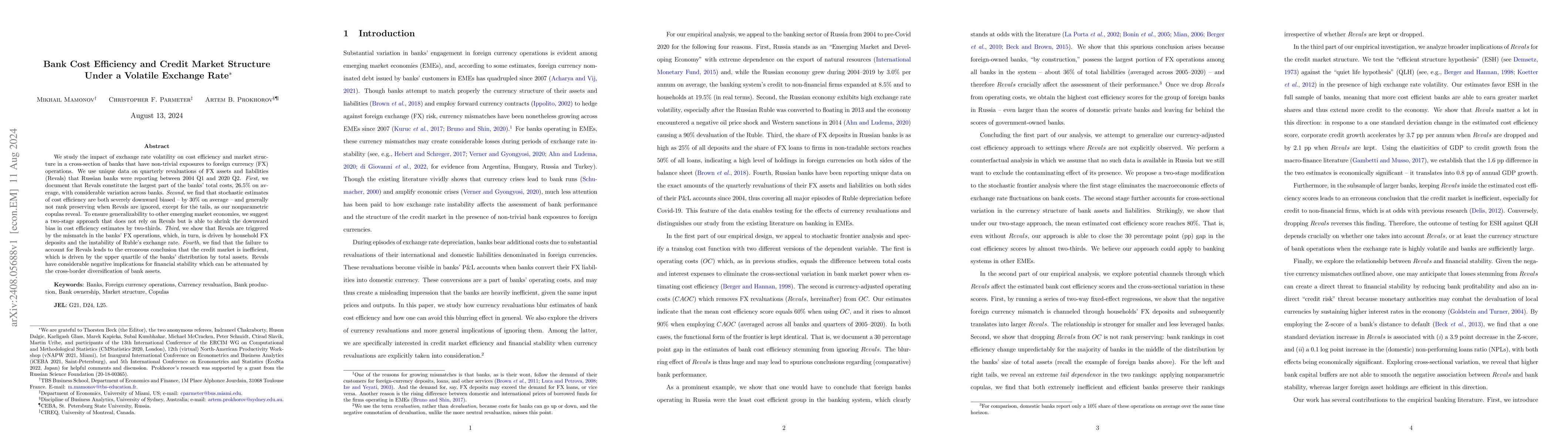

We study the impact of exchange rate volatility on cost efficiency and market structure in a cross-section of banks that have non-trivial exposures to foreign currency (FX) operations. We use unique data on quarterly revaluations of FX assets and liabilities (Revals) that Russian banks were reporting between 2004 Q1 and 2020 Q2. {\it First}, we document that Revals constitute the largest part of the banks' total costs, 26.5\% on average, with considerable variation across banks. {\it Second}, we find that stochastic estimates of cost efficiency are both severely downward biased -- by 30\% on average -- and generally not rank preserving when Revals are ignored, except for the tails, as our nonparametric copulas reveal. To ensure generalizability to other emerging market economies, we suggest a two-stage approach that does not rely on Revals but is able to shrink the downward bias in cost efficiency estimates by two-thirds. {\it Third}, we show that Revals are triggered by the mismatch in the banks' FX operations, which, in turn, is driven by household FX deposits and the instability of Ruble's exchange rate. {\it Fourth}, we find that the failure to account for Revals leads to the erroneous conclusion that the credit market is inefficient, which is driven by the upper quartile of the banks' distribution by total assets. Revals have considerable negative implications for financial stability which can be attenuated by the cross-border diversification of bank assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)