Summary

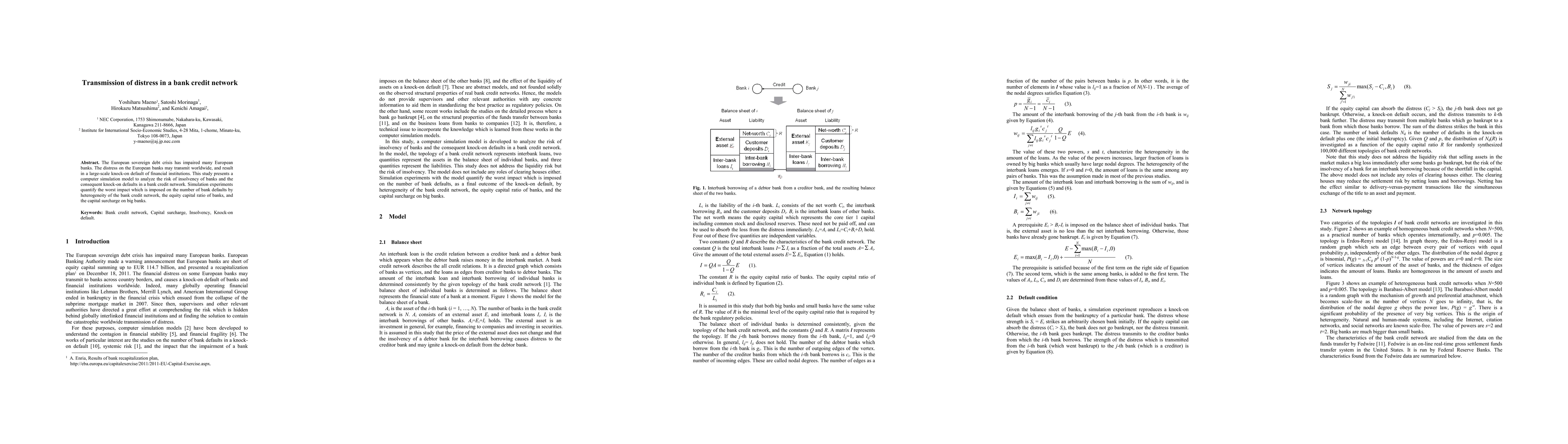

The European sovereign debt crisis has impaired many European banks. The distress on the European banks may transmit worldwide, and result in a large-scale knock-on default of financial institutions. This study presents a computer simulation model to analyze the risk of insolvency of banks and defaults in a bank credit network. Simulation experiments reproduce the knock-on default, and quantify the impact which is imposed on the number of bank defaults by heterogeneity of the bank credit network, the equity capital ratio of banks, and the capital surcharge on big banks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)