Summary

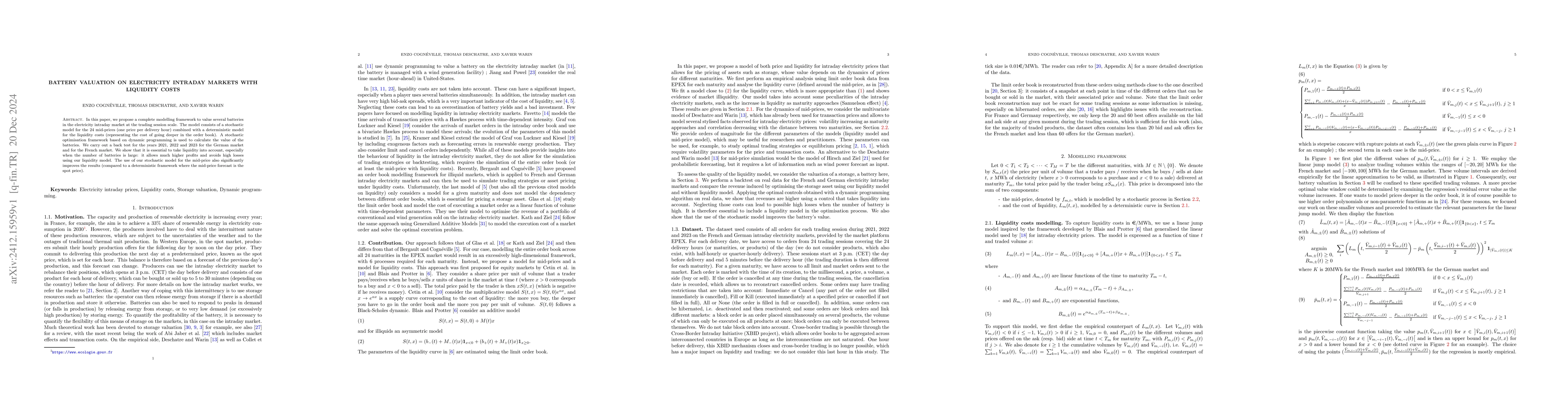

In this paper, we propose a complete modelling framework to value several batteries in the electricity intraday market at the trading session scale. The model consists of a stochastic model for the 24 mid-prices (one price per delivery hour) combined with a deterministic model for the liquidity costs (representing the cost of going deeper in the order book). A stochastic optimisation framework based on dynamic programming is used to calculate the value of the batteries. We carry out a back test for the years 2021, 2022 and 2023 for the German market and for the French market. We show that it is essential to take liquidity into account, especially when the number of batteries is large: it allows much higher profits and avoids high losses using our liquidity model. The use of our stochastic model for the mid-price also significantly improves the results (compared to a deterministic framework where the mid-price forecast is the spot price).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersRolling intrinsic for battery valuation in day-ahead and intraday markets

Daniel Oeltz, Tobias Pfingsten

A Common Shock Model for multidimensional electricity intraday price modelling with application to battery valuation

Xavier Warin, Thomas Deschatre

No citations found for this paper.

Comments (0)