Authors

Summary

Optimal portfolio allocation is often formulated as a constrained risk problem, where one aims to minimize a risk measure subject to some performance constraints. This paper presents new Bayesian Optimization algorithms for such constrained minimization problems, seeking to minimize the conditional value-at-risk (a computationally intensive risk measure) under a minimum expected return constraint. The proposed algorithms utilize a new acquisition function, which drives sampling towards the optimal region. Additionally, a new two-stage procedure is developed, which significantly reduces the number of evaluations of the expensive-to-evaluate objective function. The proposed algorithm's competitive performance is demonstrated through practical examples.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper presents new Bayesian Optimization algorithms for constrained minimization problems, specifically targeting the minimization of the Conditional Value-at-Risk (CVaR) under a minimum expected return constraint. It introduces a novel two-stage procedure to significantly reduce evaluations of the expensive-to-evaluate objective function and a new acquisition function that drives sampling towards the optimal region.

Key Results

- Proposed algorithms significantly reduce the number of evaluations of the computationally intensive CVaR objective function.

- A two-stage procedure is developed, effectively cutting down the evaluations needed for the objective function.

- The proposed algorithm demonstrates competitive performance through practical examples.

- The new acquisition function enhances the focus on the active region of the feasible space.

Significance

This research is significant for portfolio optimization problems where minimizing a computationally intensive risk measure (like CVaR) is crucial under a minimum expected return constraint. The proposed methods offer a more efficient approach, which can be beneficial in financial applications requiring robust optimization techniques.

Technical Contribution

The paper's main technical contribution is the development of new Bayesian Optimization algorithms with a novel two-stage portfolio weight selection process and a batch implementation that leverages parallel computing.

Novelty

The novelty of this work lies in the combination of a two-stage portfolio weight selection process, a new acquisition function that incorporates both feasibility and activeness, and a batch implementation that efficiently utilizes parallel computing resources.

Limitations

- The method may not guarantee finding the optimal solution for problems where solutions do not lie on the boundary of the expected return constraint.

- Reliability and safety mechanisms need to be implemented for critical applications to avoid sub-optimal solutions.

Future Work

- Investigate methods to ensure reliability and safety, especially for critical applications like automated investing.

- Explore heuristic strategies to search around obtained solutions for potentially better ones.

Paper Details

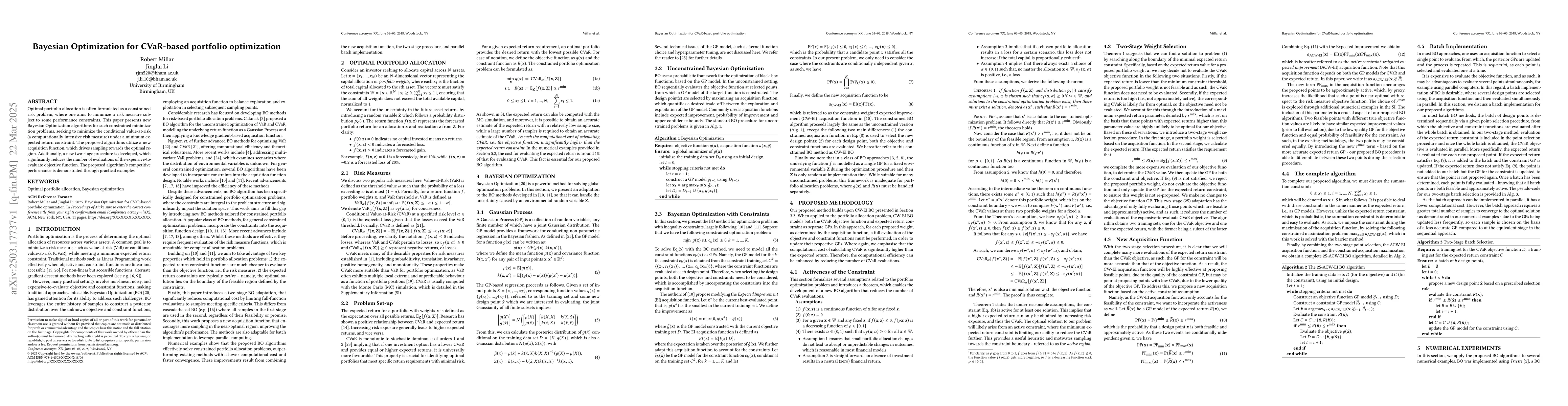

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutonomous Sparse Mean-CVaR Portfolio Optimization

Cheng Li, Zhao-Rong Lai, Yizun Lin et al.

No citations found for this paper.

Comments (0)