Summary

Integrated autoregressive conditional duration (ACD) models serve as natural counterparts to the well-known integrated GARCH models used for financial returns. However, despite their resemblance, asymptotic theory for ACD is challenging and also not complete, in particular for integrated ACD. Central challenges arise from the facts that (i) integrated ACD processes imply durations with infinite expectation, and (ii) even in the non-integrated case, conventional asymptotic approaches break down due to the randomness in the number of durations within a fixed observation period. Addressing these challenges, we provide here unified asymptotic theory for the (quasi-) maximum likelihood estimator for ACD models; a unified theory which includes integrated ACD models. Based on the new results, we also provide a novel framework for hypothesis testing in duration models, enabling inference on a key empirical question: whether durations possess a finite or infinite expectation. We apply our results to high-frequency cryptocurrency ETF trading data. Motivated by parameter estimates near the integrated ACD boundary, we assess whether durations between trades in these markets have finite expectation, an assumption often made implicitly in the literature on point process models. Our empirical findings indicate infinite-mean durations for all the five cryptocurrencies examined, with the integrated ACD hypothesis rejected -- against alternatives with tail index less than one -- for four out of the five cryptocurrencies considered.

AI Key Findings

Generated Jun 08, 2025

Methodology

The research develops unified asymptotic theory for the (quasi-) maximum likelihood estimator for ACD models, including integrated ACD models, and provides a novel framework for hypothesis testing in duration models.

Key Results

- Unified asymptotic theory for (quasi-) maximum likelihood estimator in ACD models, encompassing integrated ACD models.

- Novel hypothesis testing framework for duration models, enabling inference on finite vs. infinite expectation of durations.

- Empirical evidence from high-frequency cryptocurrency ETF trading data indicates infinite-mean durations for examined cryptocurrencies.

- Integrated ACD hypothesis rejected for four out of five cryptocurrencies, supporting alternatives with tail index less than one.

Significance

This research is important as it addresses the challenges in asymptotic theory for ACD models, especially integrated ACD, providing a comprehensive theoretical foundation and practical hypothesis testing method for duration models, which can impact the analysis of financial time series data.

Technical Contribution

The paper presents a unified asymptotic theory for the estimation of ACD models, including integrated ACD models, and develops a novel hypothesis testing framework for duration models, addressing the challenges posed by infinite-mean durations.

Novelty

This work distinguishes itself by providing a comprehensive unified asymptotic theory for ACD models, encompassing integrated cases, and introducing a novel hypothesis testing approach for inferring finite versus infinite mean durations, which was previously not available in the literature.

Limitations

- The study focuses on a specific dataset from high-frequency cryptocurrency ETF trading, so findings might not be generalizable to other financial markets without further investigation.

- The methodology's applicability to other types of duration data beyond financial transactions requires further exploration.

Future Work

- Extend the hypothesis testing framework to other financial and non-financial duration datasets for broader applicability.

- Investigate the performance and applicability of the unified asymptotic theory in various contexts beyond cryptocurrency ETF trading data.

Paper Details

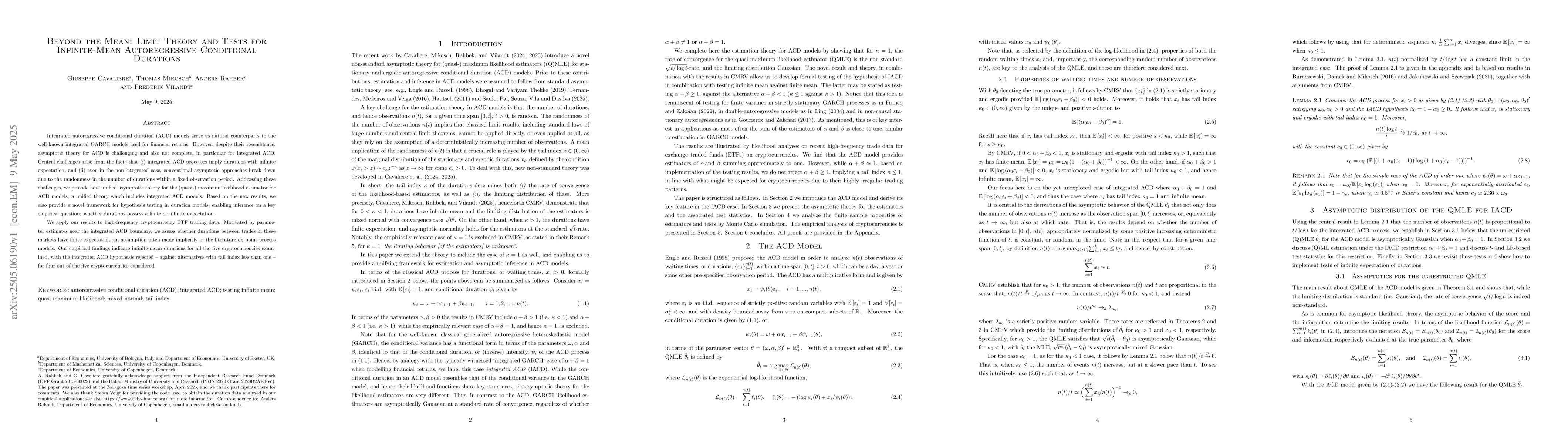

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLow temperature amorphous solids: mean field theory and beyond

Pierfrancesco Urbani

Zero-Inflated Autoregressive Conditional Duration Model for Discrete Trade Durations with Excessive Zeros

Vladimír Holý, Francisco Blasques, Petra Tomanová

No citations found for this paper.

Comments (0)