Summary

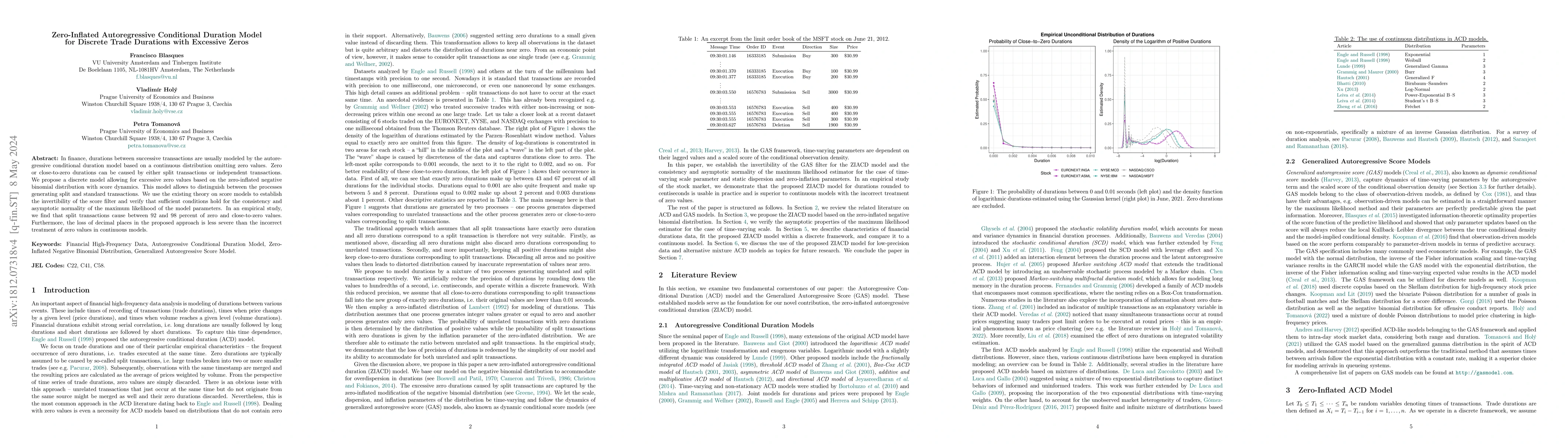

In finance, durations between successive transactions are usually modeled by the autoregressive conditional duration model based on a continuous distribution omitting zero values. Zero or close-to-zero durations can be caused by either split transactions or independent transactions. We propose a discrete model allowing for excessive zero values based on the zero-inflated negative binomial distribution with score dynamics. This model allows to distinguish between the processes generating split and standard transactions. We use the existing theory on score models to establish the invertibility of the score filter and verify that sufficient conditions hold for the consistency and asymptotic normality of the maximum likelihood of the model parameters. In an empirical study, we find that split transactions cause between 92 and 98 percent of zero and close-to-zero values. Furthermore, the loss of decimal places in the proposed approach is less severe than the incorrect treatment of zero values in continuous models.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research proposes a Zero-Inflated Autoregressive Conditional Duration (ZIACD) model for discrete trade durations, incorporating a zero-inflated negative binomial distribution with score dynamics for time-varying parameters. It extends the theory of GAS models, ensuring the invertibility of the score filter and deriving conditions for the consistency and asymptotic normality of the maximum likelihood estimator.

Key Results

- Split transactions account for 92-98% of zero and close-to-zero values.

- The proposed model outperforms traditional continuous models in estimating zero and close-to-zero values.

- The loss of decimal places in the discrete model is less severe than incorrect treatment of zero values in continuous models.

Significance

This research is significant as it addresses the issue of zero durations in finance, which are often omitted in continuous models. The proposed ZIACD model correctly handles excessive zero values and autocorrelation in durations, providing a more accurate representation of trading processes from a market microstructure perspective.

Technical Contribution

The paper extends the theory of GAS models for the zero-inflated negative binomial distribution with time-varying scale parameters, ensuring the invertibility of the score filter and deriving conditions for the consistency and asymptotic normality of the maximum likelihood estimator.

Novelty

The research introduces a discrete modeling approach for trade durations with excessive zero values, distinguishing between processes generating split and standard transactions, unlike existing continuous models that often ignore zero durations.

Limitations

- The study assumes high-precision timestamps, which may not always be available in real-world datasets.

- The model's performance might vary for different types of financial assets or markets.

Future Work

- Investigate more complex mixture models that do not require data transformation.

- Explore the application of the ZIACD model to other financial time series data.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAsymptotics for the Generalized Autoregressive Conditional Duration Model

Giuseppe Cavaliere, Thomas Mikosch, Anders Rahbek et al.

Zero-Inflated Stochastic Volatility Model for Disaggregated Inflation Data with Exact Zeros

Kaoru Irie, Geonhee Han

Parametric quantile autoregressive conditional duration models with application to intraday value-at-risk

Roberto Vila, Helton Saulo, Suvra Pal et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)