Summary

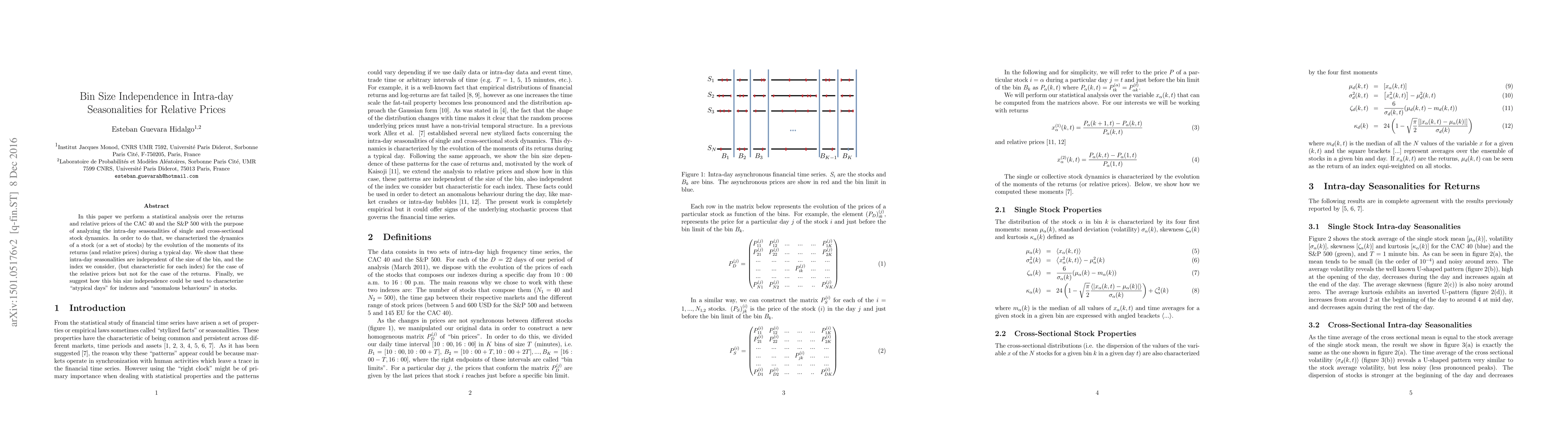

In this paper we perform a statistical analysis over the returns and relative prices of the CAC $40$ and the S\&P $500$ with the purpose of analyzing the intra-day seasonalities of single and cross-sectional stock dynamics. In order to do that, we characterized the dynamics of a stock (or a set of stocks) by the evolution of the moments of its returns (and relative prices) during a typical day. We show that these intra-day seasonalities are independent of the size of the bin, and the index we consider, (but characteristic for each index) for the case of the relative prices but not for the case of the returns. Finally, we suggest how this bin size independence could be used to characterize "atypical days" for indexes and "anomalous behaviours" in stocks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)