Summary

BSLP is a two-dimensional dynamic model of interacting portfolio-level loss and spread (more exactly, loss intensity) processes. The model is similar to the top-down HJM-like frameworks developed by Schonbucher (2005) and Sidenius-Peterbarg-Andersen (SPA) (2005), however is constructed as a Markovian, short-rate intensity model. This property of the model enables fast lattice methods for pricing various portfolio credit derivatives such as tranche options, forward-starting tranches, leveraged super-senior tranches etc. A non-parametric model specification is used to achieve nearly perfect calibration to liquid tranche quotes across strikes and maturities. A non-dynamic version of the model obtained in the zero volatility limit of stochastic intensity is useful on its own as an arbitrage-free interpolation model to price non-standard index tranches off the standard ones.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

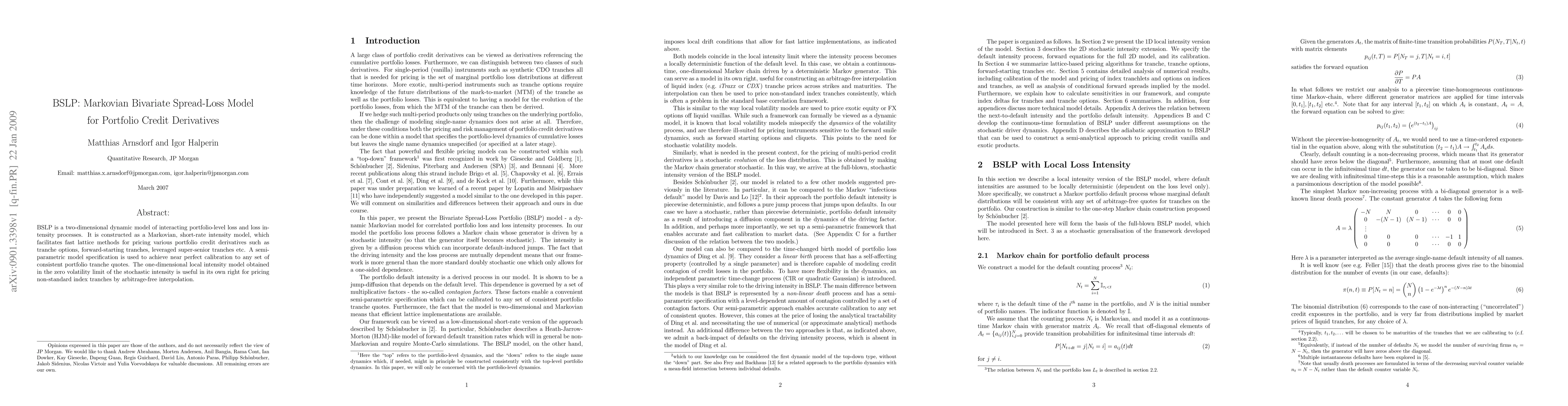

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)