Summary

The impact of a stress scenario of default events on the loss distribution of a credit portfolio can be assessed by determining the loss distribution conditional on these events. While it is conceptually easy to estimate loss distributions conditional on default events by means of Monte Carlo simulation, it becomes impractical for two or more simultaneous defaults as then the conditioning event is extremely rare. We provide an analytical approach to the calculation of the conditional loss distribution for the CreditRisk+ portfolio model with independent random loss given default distributions. The analytical solution for this case can be used to check the accuracy of an approximation to the conditional loss distribution whereby the unconditional model is run with stressed input probabilities of default (PDs). It turns out that this approximation is unbiased. Numerical examples, however, suggest that the approximation may be seriously inaccurate but that the inaccuracy leads to overestimation of tail losses and hence the approach errs on the conservative side.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

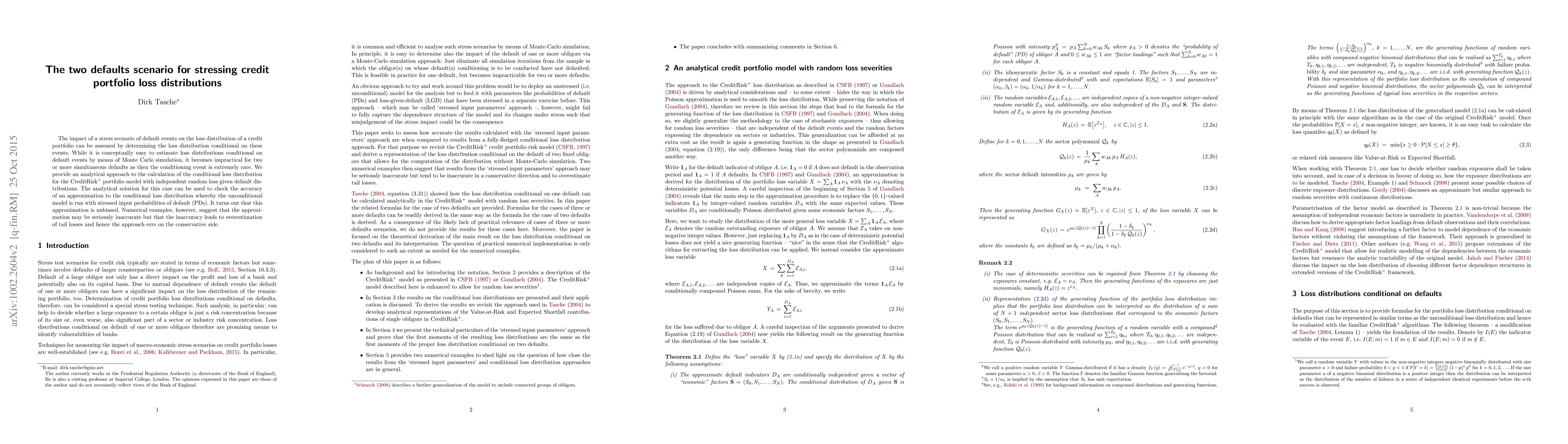

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling portfolio loss distribution under infectious defaults and immunization

Rosella Giacometti, Gabriele Torri, Gianluca Farina

| Title | Authors | Year | Actions |

|---|

Comments (0)