Summary

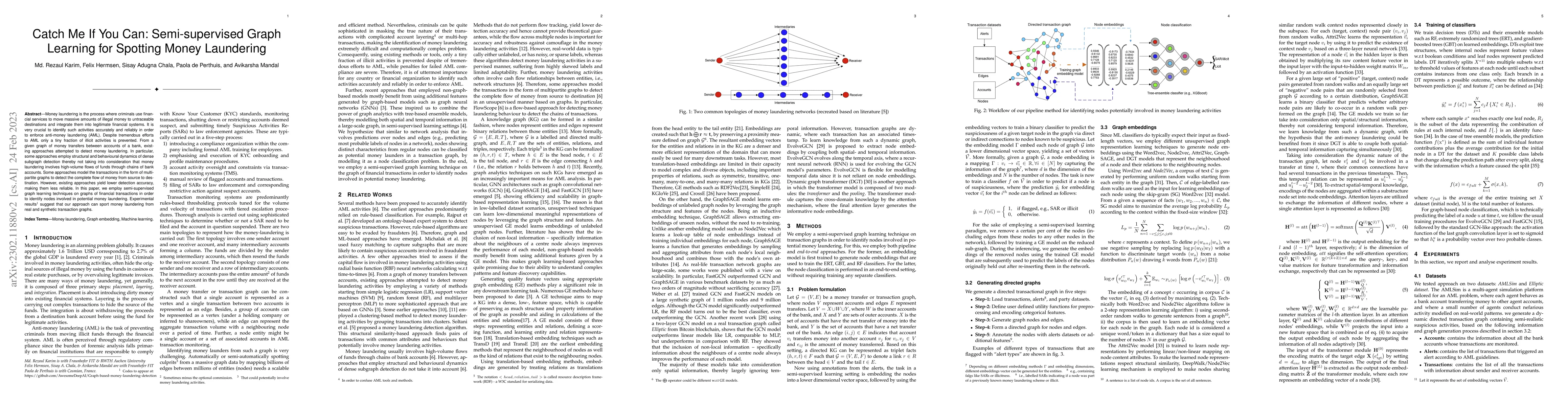

Money laundering is the process where criminals use financial services to move massive amounts of illegal money to untraceable destinations and integrate them into legitimate financial systems. It is very crucial to identify such activities accurately and reliably in order to enforce an anti-money laundering (AML). Despite tremendous efforts to AML only a tiny fraction of illicit activities are prevented. From a given graph of money transfers between accounts of a bank, existing approaches attempted to detect money laundering. In particular, some approaches employ structural and behavioural dynamics of dense subgraph detection thereby not taking into consideration that money laundering involves high-volume flows of funds through chains of bank accounts. Some approaches model the transactions in the form of multipartite graphs to detect the complete flow of money from source to destination. However, existing approaches yield lower detection accuracy, making them less reliable. In this paper, we employ semi-supervised graph learning techniques on graphs of financial transactions in order to identify nodes involved in potential money laundering. Experimental results suggest that our approach can sport money laundering from real and synthetic transaction graphs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLaundroGraph: Self-Supervised Graph Representation Learning for Anti-Money Laundering

Pedro Bizarro, Pedro Saleiro, Mário Cardoso

| Title | Authors | Year | Actions |

|---|

Comments (0)