Authors

Summary

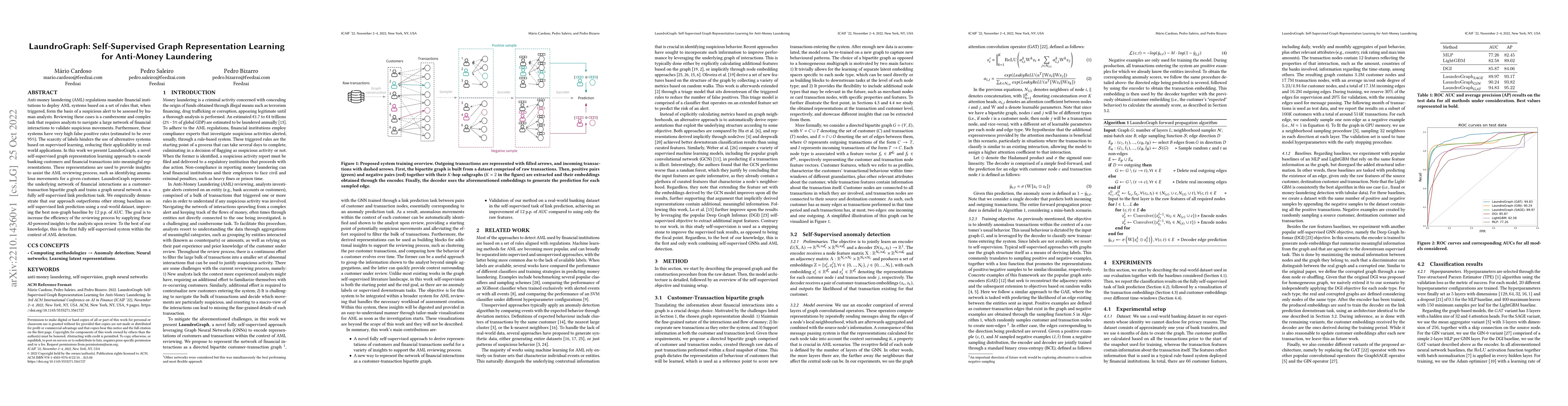

Anti-money laundering (AML) regulations mandate financial institutions to deploy AML systems based on a set of rules that, when triggered, form the basis of a suspicious alert to be assessed by human analysts. Reviewing these cases is a cumbersome and complex task that requires analysts to navigate a large network of financial interactions to validate suspicious movements. Furthermore, these systems have very high false positive rates (estimated to be over 95\%). The scarcity of labels hinders the use of alternative systems based on supervised learning, reducing their applicability in real-world applications. In this work we present LaundroGraph, a novel self-supervised graph representation learning approach to encode banking customers and financial transactions into meaningful representations. These representations are used to provide insights to assist the AML reviewing process, such as identifying anomalous movements for a given customer. LaundroGraph represents the underlying network of financial interactions as a customer-transaction bipartite graph and trains a graph neural network on a fully self-supervised link prediction task. We empirically demonstrate that our approach outperforms other strong baselines on self-supervised link prediction using a real-world dataset, improving the best non-graph baseline by $12$ p.p. of AUC. The goal is to increase the efficiency of the reviewing process by supplying these AI-powered insights to the analysts upon review. To the best of our knowledge, this is the first fully self-supervised system within the context of AML detection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCatch Me If You Can: Semi-supervised Graph Learning for Spotting Money Laundering

Felix Hermsen, Md. Rezaul Karim, Sisay Adugna Chala et al.

Inspection-L: Self-Supervised GNN Node Embeddings for Money Laundering Detection in Bitcoin

Siamak Layeghy, Marius Portmann, Wai Weng Lo et al.

Anti-Money Laundering Alert Optimization Using Machine Learning with Graphs

Ahmad Naser Eddin, Jacopo Bono, David Aparício et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)