Authors

Summary

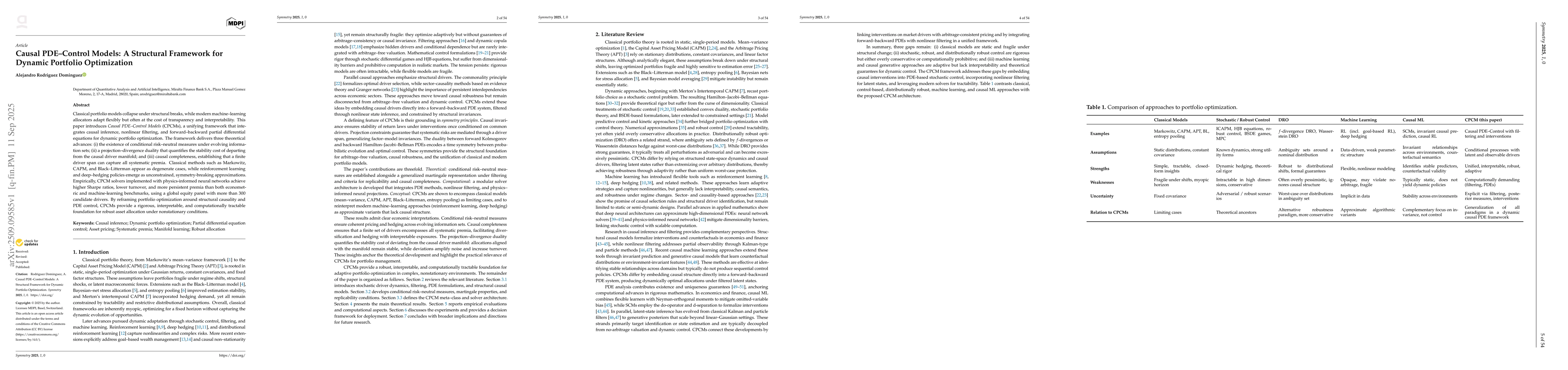

Classical portfolio models collapse under structural breaks, while modern machine-learning allocators adapt flexibly but often at the cost of transparency and interpretability. This paper introduces Causal PDE-Control Models (CPCMs), a unifying framework that integrates causal inference, nonlinear filtering, and forward-backward partial differential equations for dynamic portfolio optimization. The framework delivers three theoretical advances: (i) the existence of conditional risk-neutral measures under evolving information sets; (ii) a projection-divergence duality that quantifies the stability cost of departing from the causal driver manifold; and (iii) causal completeness, establishing that a finite driver span can capture all systematic premia. Classical methods such as Markowitz, CAPM, and Black-Litterman appear as degenerate cases, while reinforcement learning and deep-hedging policies emerge as unconstrained, symmetry-breaking approximations. Empirically, CPCM solvers implemented with physics-informed neural networks achieve higher Sharpe ratios, lower turnover, and more persistent premia than both econometric and machine-learning benchmarks, using a global equity panel with more than 300 candidate drivers. By reframing portfolio optimization around structural causality and PDE control, CPCMs provide a rigorous, interpretable, and computationally tractable foundation for robust asset allocation under nonstationary conditions.

AI Key Findings

Generated Oct 19, 2025

Methodology

The research employs a combination of dynamic-manifold optimization, PDE-constrained projections, and regime-switching strategies to evaluate portfolio allocation methods. It uses historical financial data with rolling windows for driver identification and asset moment estimation, incorporating both linear and nonlinear filtering techniques.

Key Results

- PDE-informed refinements systematically improve Sharpe ratios, Sortino ratios, and drawdown metrics across regimes

- Dynamic-manifold CPCM outperforms raw baselines by confining allocations to tangent spaces of driver-return Jacobians

- Soft-PDE interpolation parameters enable trade-offs between raw signal strength and structural coherence

Significance

This research provides a robust framework for portfolio management that balances risk and return through causal-PDE structures, offering practical deployment strategies for turbulent and stable markets alike.

Technical Contribution

The development of a dynamic-manifold CPCM framework that enforces PDE smoothness through tangent-space projections, combined with a soft-PDE interpolation parameter for balancing signal strength and structural coherence.

Novelty

This work introduces a novel integration of causal-PDE theory with financial portfolio optimization, using manifold constraints and soft-PDE interpolation to achieve both robustness and interpretability in allocation strategies.

Limitations

- Results depend on the quality and completeness of historical data for driver identification

- Assumptions about market regimes may not fully capture real-world complexities

Future Work

- Exploring real-time adaptive manifold updates for evolving market conditions

- Integrating machine learning for more accurate regime classification

- Testing across different asset classes and market conditions

Paper Details

PDF Preview

Similar Papers

Found 4 papersSemiparametric Dynamic Copula Models for Portfolio Optimization

Sujit K. Ghosh, Savita Pareek

Causal Portfolio Optimization: Principles and Sensitivity-Based Solutions

Alejandro Rodriguez Dominguez

Comments (0)