Authors

Summary

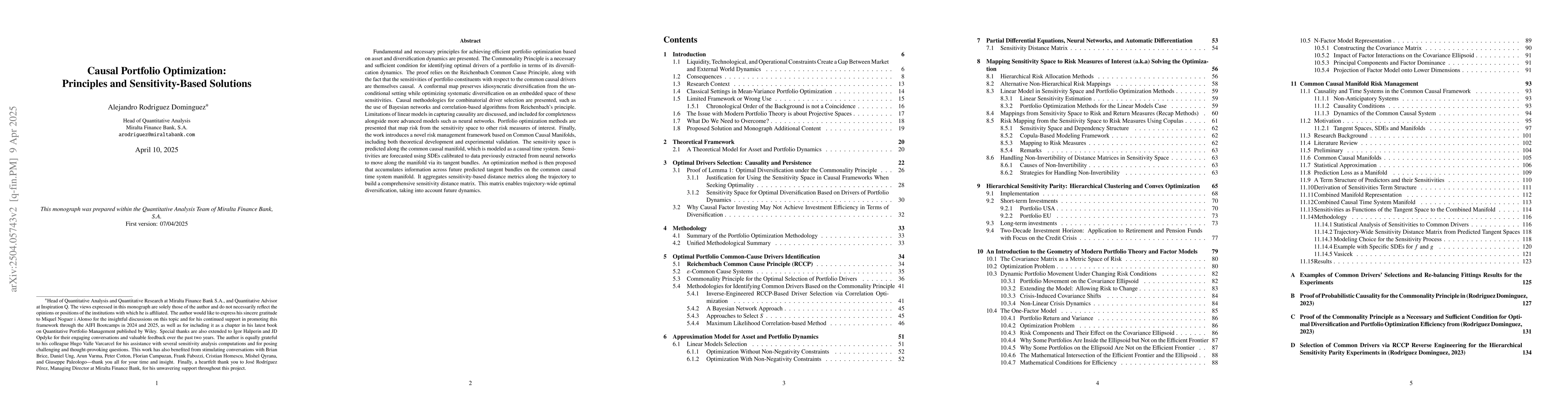

Fundamental and necessary principles for achieving efficient portfolio optimization based on asset and diversification dynamics are presented. The Commonality Principle is a necessary and sufficient condition for identifying optimal drivers of a portfolio in terms of its diversification dynamics. The proof relies on the Reichenbach Common Cause Principle, along with the fact that the sensitivities of portfolio constituents with respect to the common causal drivers are themselves causal. A conformal map preserves idiosyncratic diversification from the unconditional setting while optimizing systematic diversification on an embedded space of these sensitivities. Causal methodologies for combinatorial driver selection are presented, such as the use of Bayesian networks and correlation-based algorithms from Reichenbach's principle. Limitations of linear models in capturing causality are discussed, and included for completeness alongside more advanced models such as neural networks. Portfolio optimization methods are presented that map risk from the sensitivity space to other risk measures of interest. Finally, the work introduces a novel risk management framework based on Common Causal Manifolds, including both theoretical development and experimental validation. The sensitivity space is predicted along the common causal manifold, which is modeled as a causal time system. Sensitivities are forecasted using SDEs calibrated to data previously extracted from neural networks to move along the manifold via its tangent bundles. An optimization method is then proposed that accumulates information across future predicted tangent bundles on the common causal time system manifold. It aggregates sensitivity-based distance metrics along the trajectory to build a comprehensive sensitivity distance matrix. This matrix enables trajectory-wide optimal diversification, taking into account future dynamics.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research presents a causal portfolio optimization framework based on asset and diversification dynamics, introducing the Commonality Principle as a necessary and sufficient condition for identifying optimal drivers of a portfolio in terms of its diversification dynamics. It utilizes conformal maps to preserve idiosyncratic diversification while optimizing systematic diversification on an embedded space of sensitivities. The methodology incorporates causal methodologies for combinatorial driver selection, such as Bayesian networks and correlation-based algorithms, and proposes a novel risk management framework based on Common Causal Manifolds.

Key Results

- The Commonality Principle is established as a necessary and sufficient condition for identifying optimal portfolio drivers based on diversification dynamics.

- A conformal map is introduced to optimize systematic diversification while preserving idiosyncratic diversification.

- A novel risk management framework based on Common Causal Manifolds is presented, including theoretical development and experimental validation.

- Sensitivity-based distance metrics are aggregated across future predicted tangent bundles on the common causal time system manifold for comprehensive optimal diversification.

- The work discusses limitations of linear models in capturing causality and presents more advanced models such as neural networks.

Significance

This research is significant as it provides a causal approach to portfolio optimization, addressing the limitations of traditional methods that rely on linear models and correlation-based diversification. By focusing on causal drivers and diversification dynamics, it offers a more robust framework for portfolio management, which can lead to improved risk management and potentially higher returns.

Technical Contribution

The paper's main technical contribution lies in the formulation of the Commonality Principle and its application to portfolio optimization, along with the development of a conformal mapping technique for optimizing diversification on an embedded space of sensitivities.

Novelty

This work stands out by integrating causal methodologies into portfolio optimization, moving beyond traditional correlation-based approaches. It introduces the concept of Common Causal Manifolds for risk management, providing a novel perspective on how to structure and manage portfolio risk.

Limitations

- The methodology assumes that causal relationships can be accurately identified and modeled, which may not always be the case in complex financial markets.

- The use of advanced models like neural networks, while more accurate, can be computationally intensive and may require substantial data for training.

Future Work

- Investigate methods to improve the identification and modeling of causal relationships in financial markets.

- Explore the application of the proposed framework to other asset classes beyond equities and fixed income.

- Develop strategies to reduce the computational complexity of the neural network-based sensitivity estimation.

Paper Details

PDF Preview

Similar Papers

Found 4 papersSensitivity of causal distributionally robust optimization

Yifan Jiang, Jan Obloj

Portfolio Optimization based on Neural Networks Sensitivities from Assets Dynamics respect Common Drivers

Alejandro Rodriguez Dominguez

No citations found for this paper.

Comments (0)