Summary

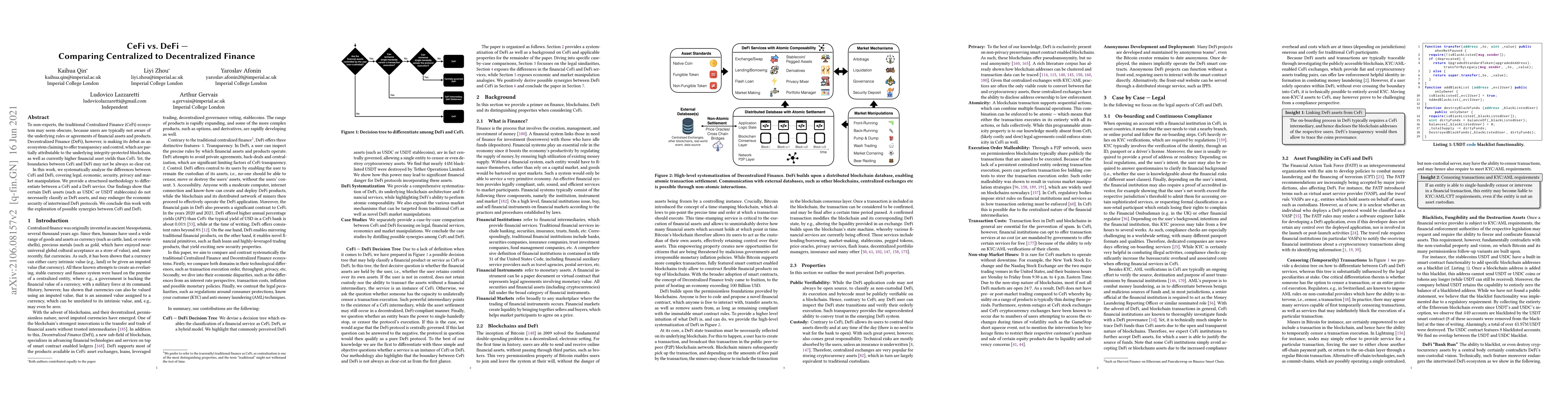

To non-experts, the traditional Centralized Finance (CeFi) ecosystem may seem obscure, because users are typically not aware of the underlying rules or agreements of financial assets and products. Decentralized Finance (DeFi), however, is making its debut as an ecosystem claiming to offer transparency and control, which are partially attributable to the underlying integrity-protected blockchain, as well as currently higher financial asset yields than CeFi. Yet, the boundaries between CeFi and DeFi may not be always so clear cut. In this work, we systematically analyze the differences between CeFi and DeFi, covering legal, economic, security, privacy and market manipulation. We provide a structured methodology to differentiate between a CeFi and a DeFi service. Our findings show that certain DeFi assets (such as USDC or USDT stablecoins) do not necessarily classify as DeFi assets, and may endanger the economic security of intertwined DeFi protocols. We conclude this work with the exploration of possible synergies between CeFi and DeFi.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoK: Decentralized Finance (DeFi)

William J. Knottenbelt, Ariah Klages-Mundt, Lewis Gudgeon et al.

Decentralized Finance (DeFi): A Survey

Xinyu Li, Jian Weng, Chenyang Wang et al.

SoK: Decentralized Finance (DeFi) Attacks

Dawn Song, Ye Wang, Roger Wattenhofer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)