Summary

The recent emergence of cryptocurrencies such as Bitcoin and Ethereum has posed possible alternatives to global payments as well as financial assets around the globe, making investors and financial regulators aware of the importance of modeling them correctly. The Levy's stable distribution is one of the attractive distributions that well describes the fat tails and scaling phenomena in economic systems. In this paper, we show that the behaviors of price fluctuations in emerging cryptocurrency markets can be characterized by a non-Gaussian Levy's stable distribution with $\alpha \simeq 1.4$ under certain conditions on time intervals ranging roughly from 30 minutes to 4 hours. Our arguments are developed under quantitative valuation defined as a distance function using the Parseval's relation in addition to the theoretical background of the General Central Limit Theorem (GCLT). We also discuss the fit with the Levy's stable distribution compared to the fit with other distributions by employing the method based on likelihood ratios. Our approach can be extended for further analysis of statistical properties and contribute to developing proper applications for financial modeling.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

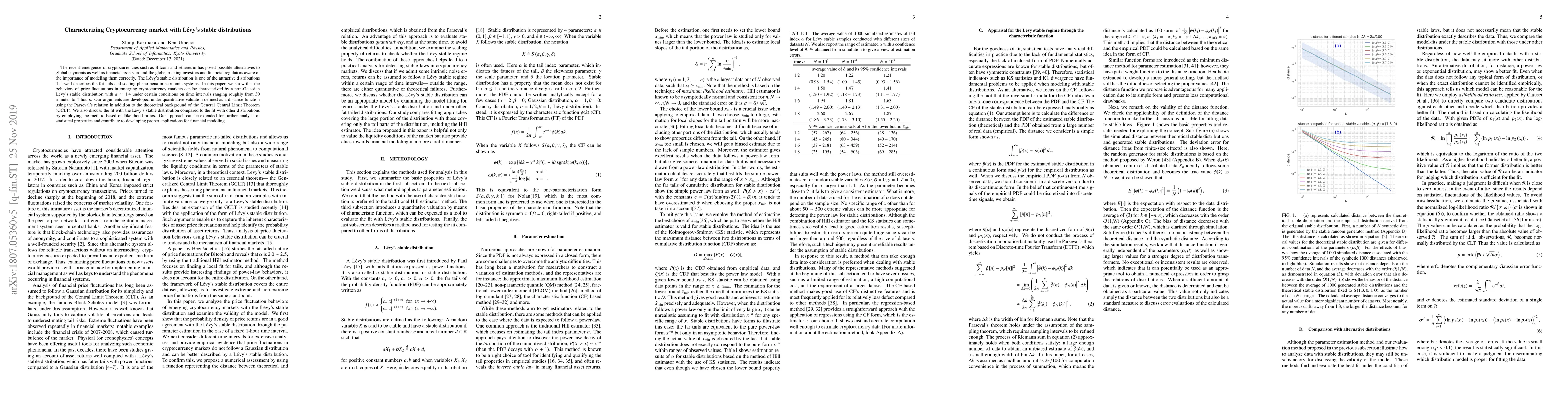

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian framework for characterizing cryptocurrency market dynamics, structural dependency, and volatility using potential field

Anoop C V, Neeraj Negi, Anup Aprem

| Title | Authors | Year | Actions |

|---|

Comments (0)