Summary

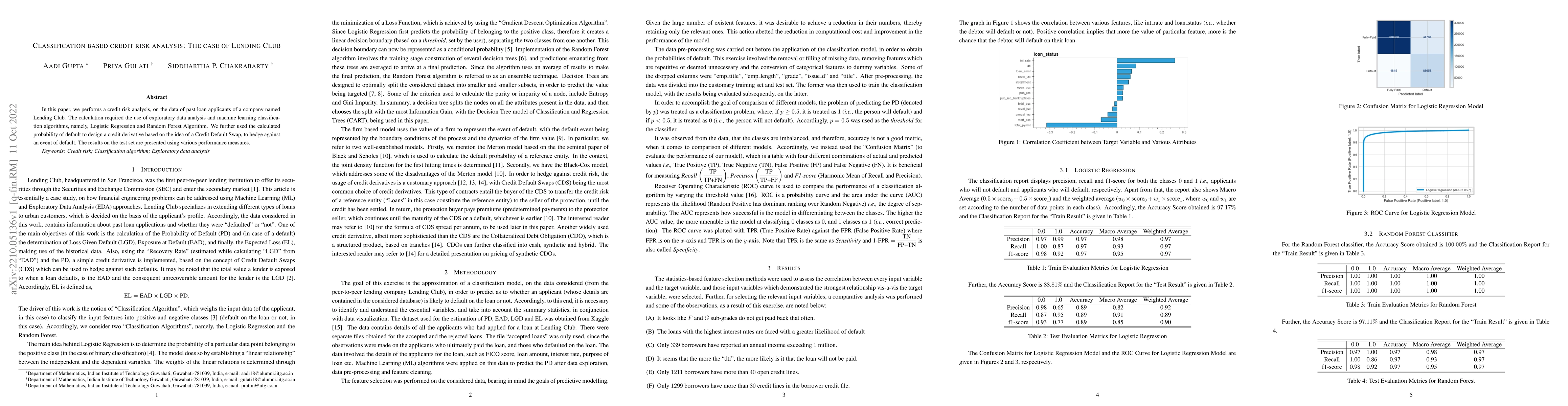

In this paper, we performs a credit risk analysis, on the data of past loan applicants of a company named Lending Club. The calculation required the use of exploratory data analysis and machine learning classification algorithms, namely, Logistic Regression and Random Forest Algorithm. We further used the calculated probability of default to design a credit derivative based on the idea of a Credit Default Swap, to hedge against an event of default. The results on the test set are presented using various performance measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)