Summary

In this paper I extend the work of Bernhardt and Donnelly (2019) dealing with modern explicit tontines, as a way of providing income under a specified bequest motive, from a defined contribution pension pot. A key feature of the present paper is that it relaxes the assumption of fixed proportions invested in tontine and bequest accounts. In making the bequest proportion an additional control function I obtain, hitherto unavailable, closed-form solutions for the fractional consumption rate, wealth, bequest amount, and bequest proportion under a constant relative risk averse utility. I show that the optimal bequest proportion is the product of the optimum fractional consumption rate and an exponentiated bequest parameter. I show that under certain circumstances, such as a very high bequest motive, a life-cycle utility maximisation strategy will necessitate negative mortality credits analogous to a member paying life insurance premiums. Typical scenarios are explored using UK Office of National Statistics life tables.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

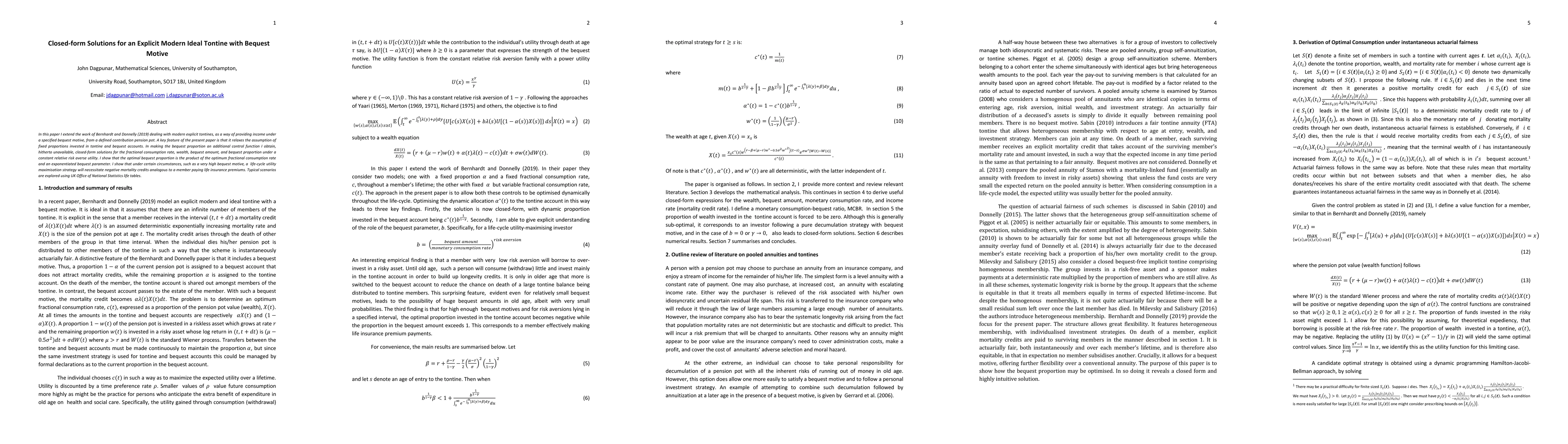

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)