Authors

Summary

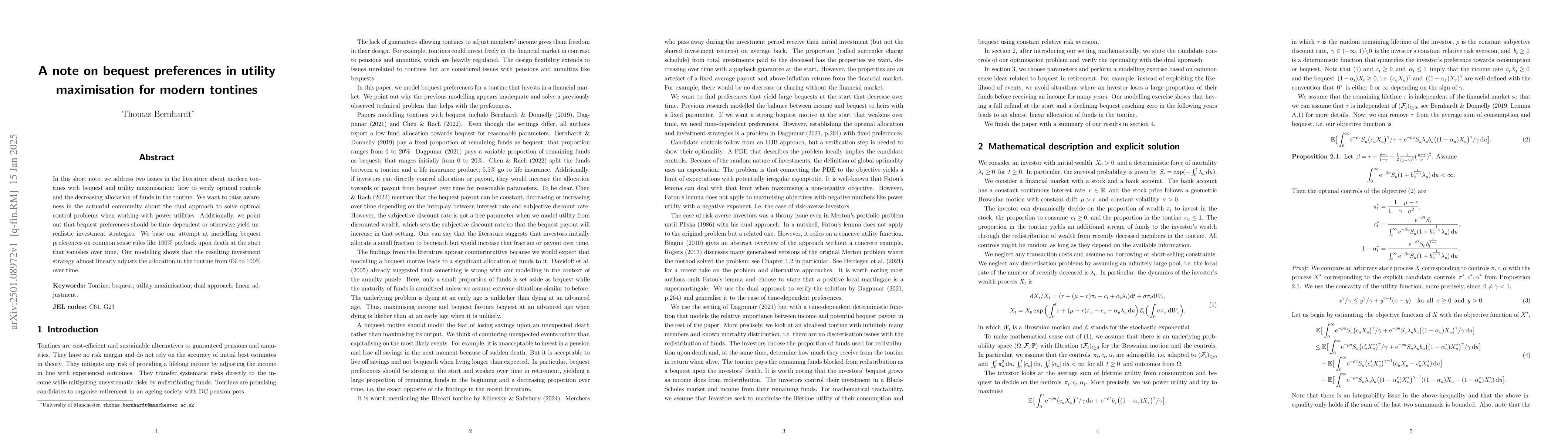

In this short note, we address two issues in the literature about modern tontines with bequest and utility maximisation: how to verify optimal controls and the decreasing allocation of funds in the tontine. We want to raise awareness in the actuarial community about the dual approach to solve optimal control problems when working with power utilities. Additionally, we point out that bequest preferences should be time-dependent or otherwise yield unrealistic investment strategies. We base our attempt at modelling bequest preferences on common sense rules like 100% payback upon death at the start that vanishes over time. Our modelling shows that the resulting investment strategy almost linearly adjusts the allocation in the tontine from 0% to 100% over time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)