Summary

We introduce a new pension product that offers retirees the opportunity for a lifelong income and a bequest for their estate. Based on a tontine mechanism, the product divides pension savings between a tontine account and a bequest account. The tontine account is given up to a tontine pool upon death while the bequest account value is paid to the retiree's estate. The values of these two accounts are continuously re-balanced to the same proportion, which is the key feature of our new product. Our main research question about the new product is what proportion of pension savings should a retiree allocate to the tontine account. Under a power utility function, we show that more risk averse retirees allocate a fairly stable proportion of their pension savings to the tontine account, regardless of the strength of their bequest motive. The proportion declines as the retiree becomes less risk averse for a while. However, for the least risk averse retirees, a high proportion of their pension savings is optimally allocated to the tontine account. This surprising result is explained by the least risk averse retirees seeking the potentially high value of the bequest account at very old ages.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

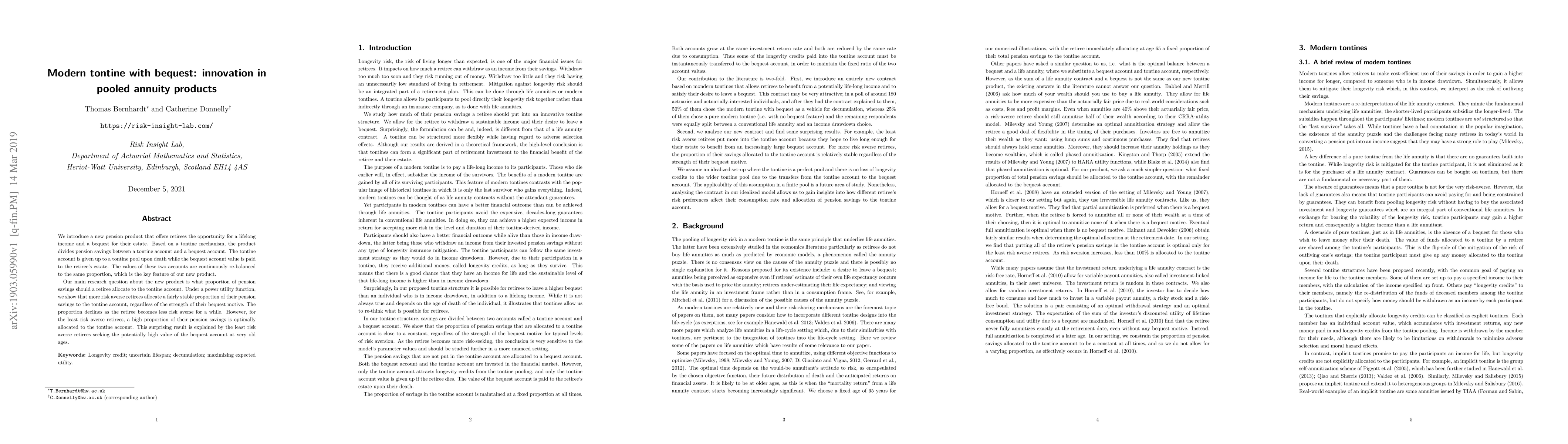

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLife cycle insurance, bequest motives and annuity loads

Pavel V. Shevchenko, Aleksandar Arandjelović, Geoffrey Kingston

| Title | Authors | Year | Actions |

|---|

Comments (0)