Summary

In this paper we present a duality theory for the robust utility maximisation problem in continuous time for utility functions defined on the positive real axis. Our results are inspired by -- and can be seen as the robust analogues of -- the seminal work of Kramkov & Schachermayer [18]. Namely, we show that if the set of attainable trading outcomes and the set of pricing measures satisfy a bipolar relation, then the utility maximisation problem is in duality with a conjugate problem. We further discuss the existence of optimal trading strategies. In particular, our general results include the case of logarithmic and power utility, and they apply to drift and volatility uncertainty.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

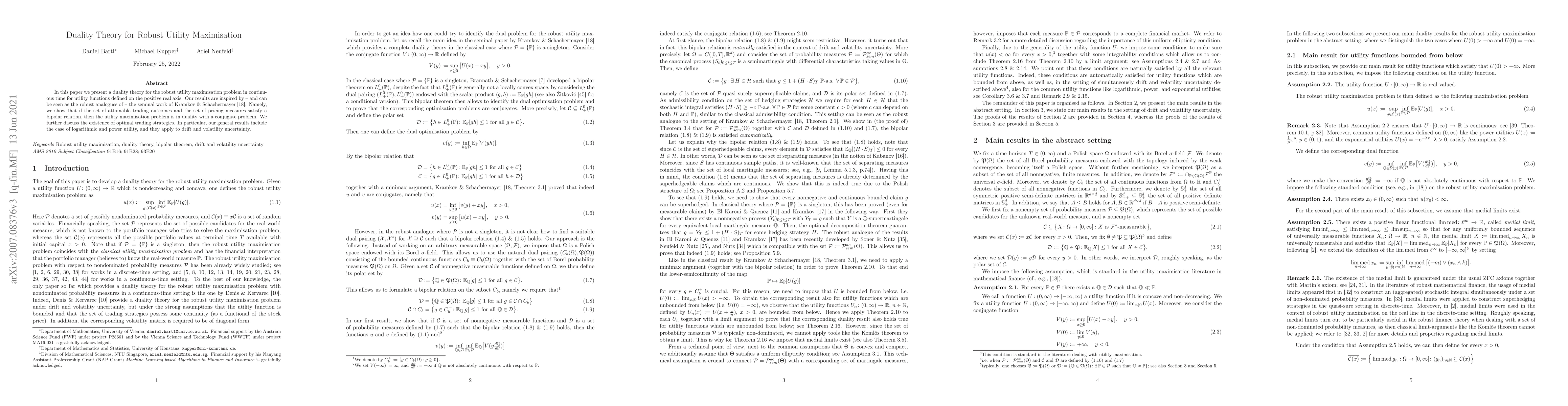

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUtility maximisation and time-change

Giulia Di Nunno, Hannes Haferkorn, Asma Khedher et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)