Summary

We consider robust utility maximisation in continuous-time financial markets with proportional transaction costs under model uncertainty. For this, we work in the framework of Chau and R\'asonyi (2019), where robustness is achieved by maximising the worst-case expected utility over a possibly uncountable class of models that are all given on the same underlying filtered probability space with incomplete filtration. In this setting, we give sufficient conditions for the existence of an optimal trading strategy extending the result for utility functions on the positive half-line of Chau and R\'asonyi (2019) from continuous to general strictly positive c\`adl\`ag price processes. This allows us to provide a positive answer to an open question pointed out in Chau and R\'asonyi (2019), and shows that the embedding into a countable product space is not essential.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

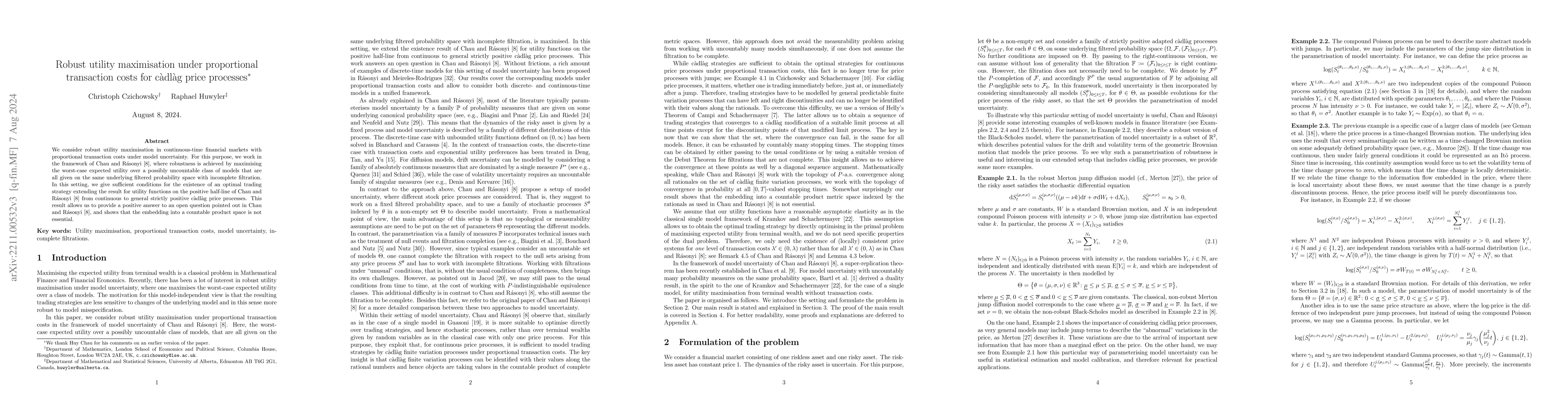

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)