Authors

Summary

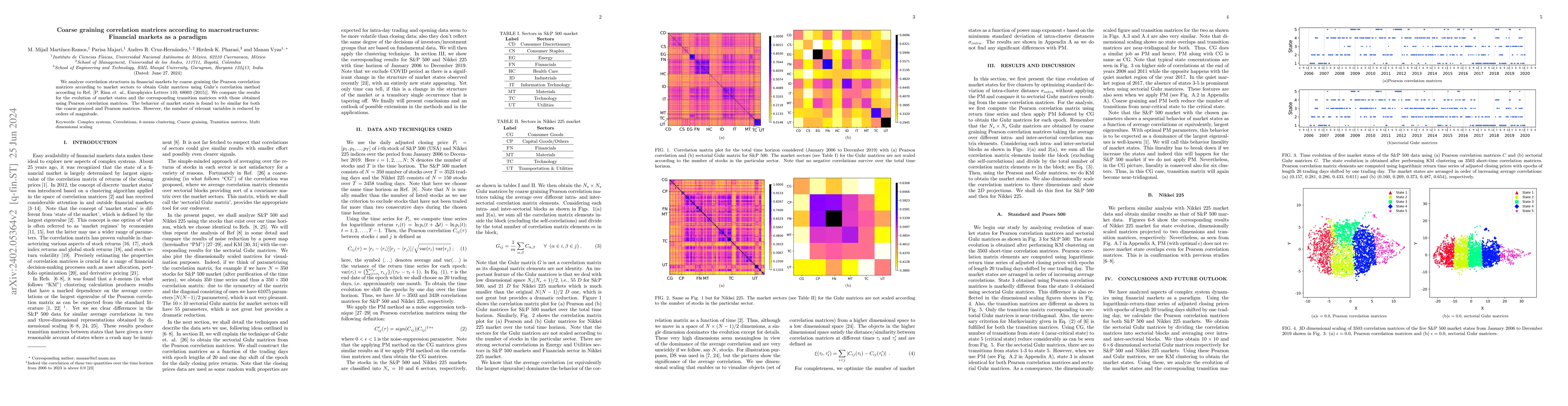

We analyze correlation structures in financial markets by coarse graining the Pearson correlation matrices according to market sectors to obtain Guhr matrices using Guhr's correlation method according to Ref. [P. Rinn {\it et. al.}, Europhysics Letters 110, 68003 (2015)]. We compare the results for the evolution of market states and the corresponding transition matrices with those obtained using Pearson correlation matrices. The behavior of market states is found to be similar for both the coarse grained and Pearson matrices. However, the number of relevant variables is reduced by orders of magnitude.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)