Summary

In a multi objective setting, a portfolio manager's highly consequential decisions can benefit from assessing alternative forecasting models of stock index movement. The present investigation proposes a new approach to identify a set of nondominated neural network models for further selection by the decision maker. A new coevolution approach is proposed to simultaneously select the features and topology of neural networks (collectively referred to as neural architecture), where the features are viewed from a topological perspective as input neurons. Further, the coevolution is posed as a multicriteria problem to evolve sparse and efficacious neural architectures. The well known dominance and decomposition based multiobjective evolutionary algorithms are augmented with a nongeometric crossover operator to diversify and balance the search for neural architectures across conflicting criteria. Moreover, the coevolution is augmented to accommodate the data based implications of distinct market behaviors prior to and during the ongoing COVID 19 pandemic. A detailed comparative evaluation is carried out with the conventional sequential approach of feature selection followed by neural topology design, as well as a scalarized coevolution approach. The results on the NASDAQ index in pre and peri COVID time windows convincingly demonstrate that the proposed coevolution approach can evolve a set of nondominated neural forecasting models with better generalization capabilities.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research proposes a coevolution approach for simultaneously selecting features and neural network topologies using multi-objective decision perspectives. It employs MOEAs, augmented with a non-geometric crossover operator, to evolve sparse and efficient neural architectures. The approach accommodates distinct market behaviors pre- and during the COVID-19 pandemic.

Key Results

- The proposed coevolution approach identifies a set of non-dominated neural network models for further selection by the decision-maker.

- Detailed comparative evaluation demonstrates that the proposed approach outperforms conventional sequential and scalarized coevolution approaches in evolving non-dominated neural forecasting models with better generalization capabilities.

- The study considers 21 different neural architecture design approaches for comparative evaluation, representing prevailing design approaches in existing stock index movement investigations.

- Comparative evaluation shows statistically significant improvement with the co-evolution approach over baseline approaches.

- The investigation reveals that it's possible to obtain insufficient forecasting models conforming to market efficiency or being brute-in nature due to improper feature and neural topology selection.

Significance

This research is significant as it presents a novel co-evolution approach for designing neural architectures for stock market forecasting, providing decision-makers with a higher degree of selection freedom for preferred criteria.

Technical Contribution

The main technical contribution is the proposed co-evolution framework that simultaneously selects features and neural network topologies, balancing parsimony and efficacy for forecasting performance over pre- and within-COVID datasets.

Novelty

This work is novel as it introduces a multi-objective decision perspective to co-evolve neural architectures and features for stock market forecasting, addressing the need for balanced and efficient models in the presence of market uncertainties.

Limitations

- The study focuses on classification metrics for evaluating forecasting performance; profitability-related metrics could be considered for a more comprehensive evaluation.

- The co-evolution framework's applicability to datasets with a significantly larger or smaller number of features remains untested.

Future Work

- Explore the construction of trading strategies using the model predictions as a future exercise.

- Investigate the co-evolution of neural architectures for other financial datasets or time series prediction problems.

- Consider alternative metrics closer to profitability for evaluating forecasting performance.

Paper Details

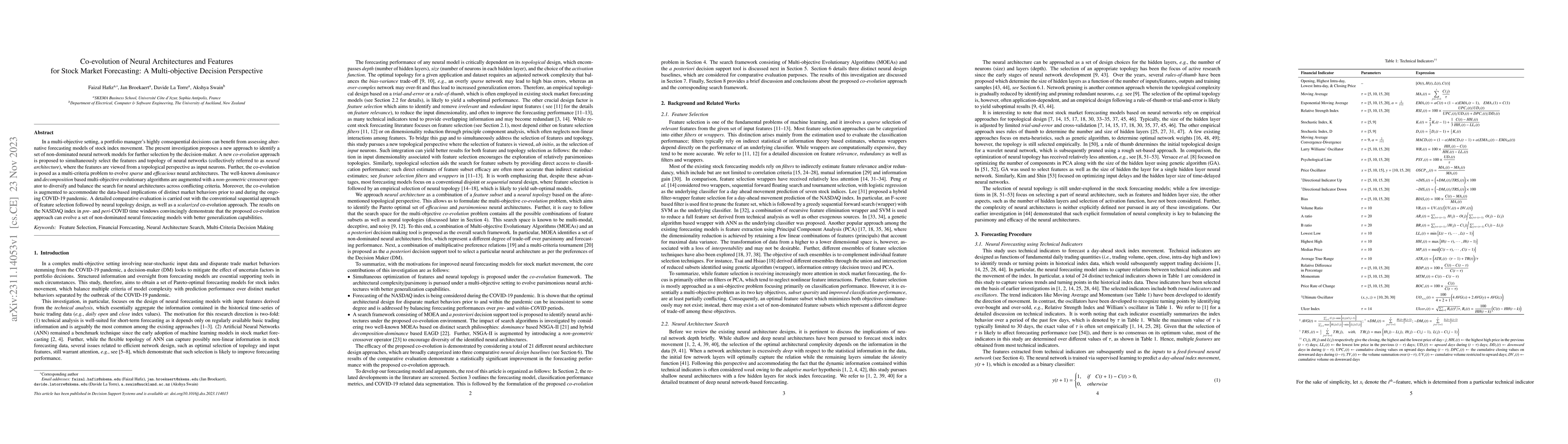

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMASTER: Market-Guided Stock Transformer for Stock Price Forecasting

Yanyan Shen, Zhaoyang Liu, Tong Li et al.

A Neuro-Fuzzy System for Interpretable Long-Term Stock Market Forecasting

Vitomir Štruc, Igor Škrjanc, Miha Ožbot

Forecasting realized volatility in the stock market: a path-dependent perspective

Sicheng Fu, Shaopeng Hong, Xiangdong Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)