Authors

Summary

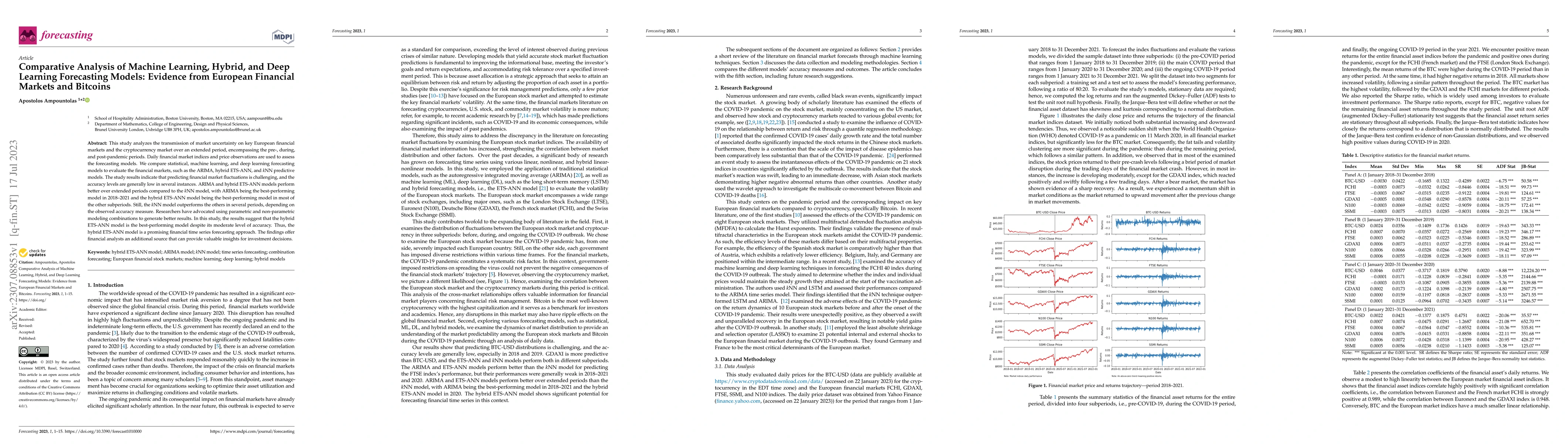

This study analyzes the transmission of market uncertainty on key European financial markets and the cryptocurrency market over an extended period, encompassing the pre, during, and post-pandemic periods. Daily financial market indices and price observations are used to assess the forecasting models. We compare statistical, machine learning, and deep learning forecasting models to evaluate the financial markets, such as the ARIMA, hybrid ETS-ANN, and kNN predictive models. The study results indicate that predicting financial market fluctuations is challenging, and the accuracy levels are generally low in several instances. ARIMA and hybrid ETS-ANN models perform better over extended periods compared to the kNN model, with ARIMA being the best-performing model in 2018-2021 and the hybrid ETS-ANN model being the best-performing model in most of the other subperiods. Still, the kNN model outperforms the others in several periods, depending on the observed accuracy measure. Researchers have advocated using parametric and non-parametric modeling combinations to generate better results. In this study, the results suggest that the hybrid ETS-ANN model is the best-performing model despite its moderate level of accuracy. Thus, the hybrid ETS-ANN model is a promising financial time series forecasting approach. The findings offer financial analysts an additional source that can provide valuable insights for investment decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHybrid Models for Financial Forecasting: Combining Econometric, Machine Learning, and Deep Learning Models

Robert Ślepaczuk, Dominik Stempień

Financial Time-Series Forecasting: Towards Synergizing Performance And Interpretability Within a Hybrid Machine Learning Approach

Shun Liu, Bin Huang, Chufeng Jiang et al.

Advancing Exchange Rate Forecasting: Leveraging Machine Learning and AI for Enhanced Accuracy in Global Financial Markets

Rajan Das Gupta, Md. Yeasin Rahat, Nur Raisa Rahman et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)