Summary

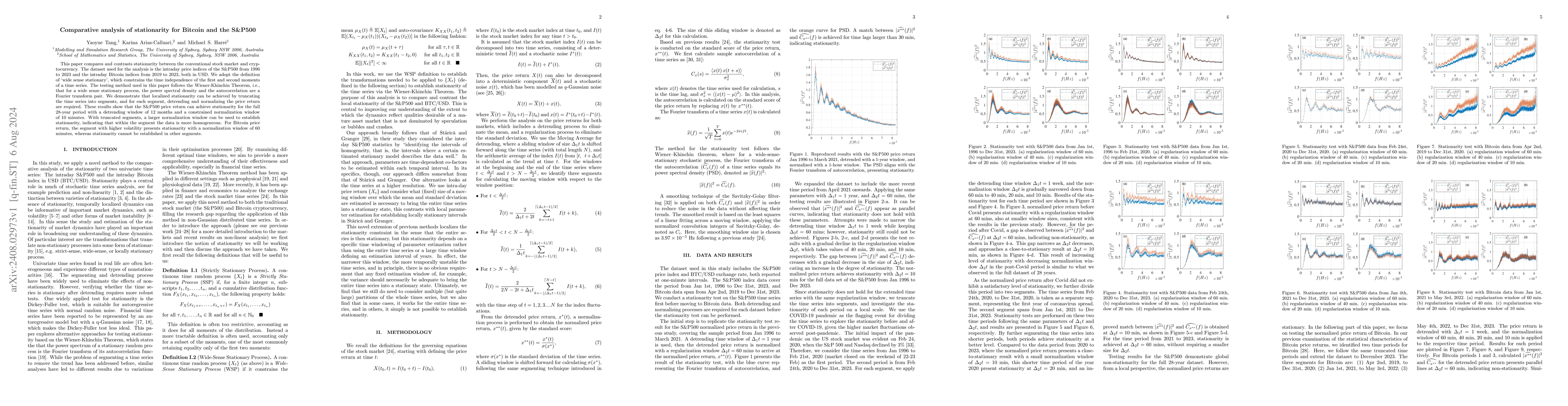

This paper compares and contrasts stationarity between the conventional stock market and cryptocurrency. The dataset used for the analysis is the intraday price indices of the S&P500 from 1996 to 2023 and the intraday Bitcoin indices from 2019 to 2023, both in USD. We adopt the definition of `wide sense stationary', which constrains the time independence of the first and second moments of a time series. The testing method used in this paper follows the Wiener-Khinchin Theorem, i.e., that for a wide sense stationary process, the power spectral density and the autocorrelation are a Fourier transform pair. We demonstrate that localized stationarity can be achieved by truncating the time series into segments, and for each segment, detrending and normalizing the price return are required. These results show that the S&P500 price return can achieve stationarity for the full 28-year period with a detrending window of 12 months and a constrained normalization window of 10 minutes. With truncated segments, a larger normalization window can be used to establish stationarity, indicating that within the segment the data is more homogeneous. For Bitcoin price return, the segment with higher volatility presents stationarity with a normalization window of 60 minutes, whereas stationarity cannot be established in other segments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExact Post-selection Inference For Tracking S&P500

Farshad Noravesh, Hamid Boustanifar

No citations found for this paper.

Comments (0)