Summary

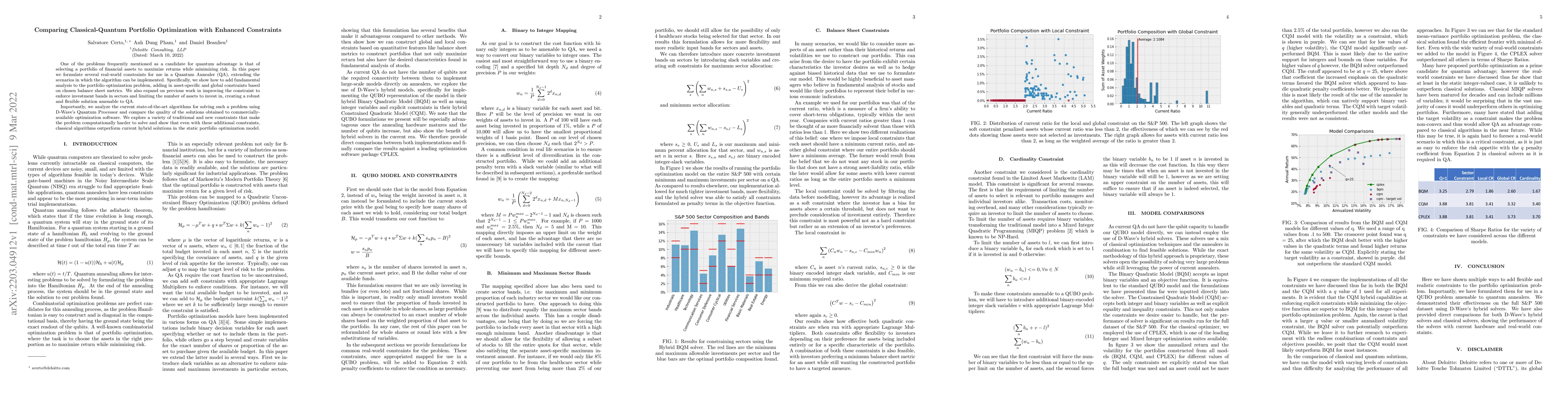

One of the problems frequently mentioned as a candidate for quantum advantage is that of selecting a portfolio of financial assets to maximize returns while minimizing risk. In this paper we formulate several real-world constraints for use in a Quantum Annealer (QA), extending the scenarios in which the algorithm can be implemented. Specifically, we show how to add fundamental analysis to the portfolio optimization problem, adding in asset-specific and global constraints based on chosen balance sheet metrics. We also expand on previous work in improving the constraint to enforce investment bands in sectors and limiting the number of assets to invest in, creating a robust and flexible solution amenable to QA. Importantly, we analyze the current state-of-the-art algorithms for solving such a problem using D-Wave's Quantum Processor and compare the quality of the solutions obtained to commercially-available optimization software. We explore a variety of traditional and new constraints that make the problem computationally harder to solve and show that even with these additional constraints, classical algorithms outperform current hybrid solutions in the static portfolio optimization model.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research formulates real-world constraints for Quantum Annealer (QA) use, including fundamental analysis and sector-based investment bands, then compares classical algorithms to hybrid quantum solutions using D-Wave's Quantum Processor.

Key Results

- Classical algorithms outperform current hybrid solutions in static portfolio optimization even with additional constraints.

- Hybrid solvers allow for tighter investment bands, more flexibility, and satisfaction of all formulated constraints as penalty terms in the objective function.

- Both local and global constraints for minimum current ratio are effective, offering flexibility based on investor preferences.

Significance

This research is important for understanding the current state of quantum advantage in financial portfolio optimization, highlighting that real-world constraints make it unlikely for quantum algorithms to outperform classical solutions in the static, integer-valued case.

Technical Contribution

The paper presents methods for incorporating real-world constraints into quantum portfolio optimization models, specifically using D-Wave's hybrid solvers and formulating constraints as penalty terms in the objective function.

Novelty

This work extends previous research by adding fundamental analysis and sector-based constraints, providing a more comprehensive and realistic approach to quantum portfolio optimization.

Limitations

- Current quantum hardware lacks qubit capacity to handle large-scale models directly.

- The study focuses on static portfolio optimization, potentially limiting its applicability to dynamic scenarios.

Future Work

- Explore the impact of target volatility as a constraint on quantum advantage in portfolio optimization.

- Investigate the performance of quantum algorithms in dynamic portfolio optimization scenarios.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantum Portfolio Optimization: An Extensive Benchmark

Friedrich Wagner, Eric Stopfer

End-to-End Portfolio Optimization with Quantum Annealing

Kazuki Ikeda, Sai Nandan Morapakula, Sangram Deshpande et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)