Authors

Summary

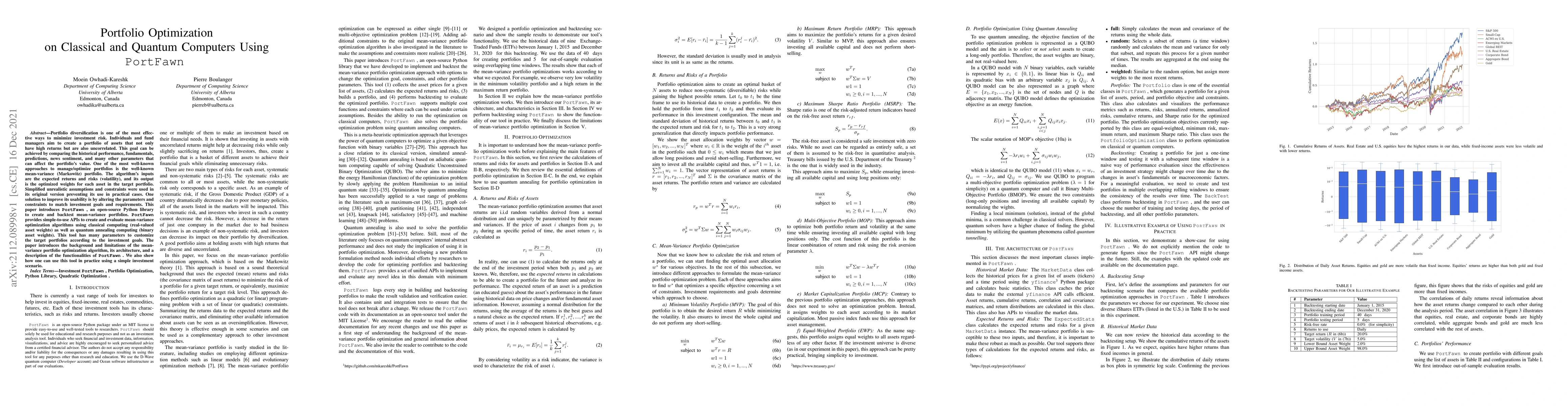

Portfolio diversification is one of the most effective ways to minimize investment risk. Individuals and fund managers aim to create a portfolio of assets that not only have high returns but are also uncorrelated. This goal can be achieved by comparing the historical performance, fundamentals, predictions, news sentiment, and many other parameters that can affect the portfolio's value. One of the most well-known approaches to manage/optimize portfolios is the well-known mean-variance (Markowitz) portfolio. The algorithm's inputs are the expected returns and risks (volatility), and its output is the optimized weights for each asset in the target portfolio. Simplified unrealistic assumptions and constraints were used in its original version preventing its use in practical cases. One solution to improve its usability is by altering the parameters and constraints to match investment goals and requirements. This paper introduces PortFawn, an open-source Python library to create and backtest mean-variance portfolios. PortFawn provides simple-to-use APIs to create and evaluate mean-variance optimization algorithms using classical computing (real-valued asset weights) as well as quantum annealing computing (binary asset weights). This tool has many parameters to customize the target portfolios according to the investment goals. The paper introduces the background and limitations of the mean-variance portfolio optimization algorithm, its architecture, and a description of the functionalities of PortFawn. We also show how one can use this tool in practice using a simple investment scenario.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBlack-Litterman Portfolio Optimization with Noisy Intermediate-Scale Quantum Computers

Hsi-Sheng Goan, Chi-Chun Chen, San-Lin Chung

A Quantum Online Portfolio Optimization Algorithm

Patrick Rebentrost, Debbie Lim

Comparing Classical-Quantum Portfolio Optimization with Enhanced Constraints

Salvatore Certo, Daniel Beaulieu, Anh Dung Pham

| Title | Authors | Year | Actions |

|---|

Comments (0)