Authors

Summary

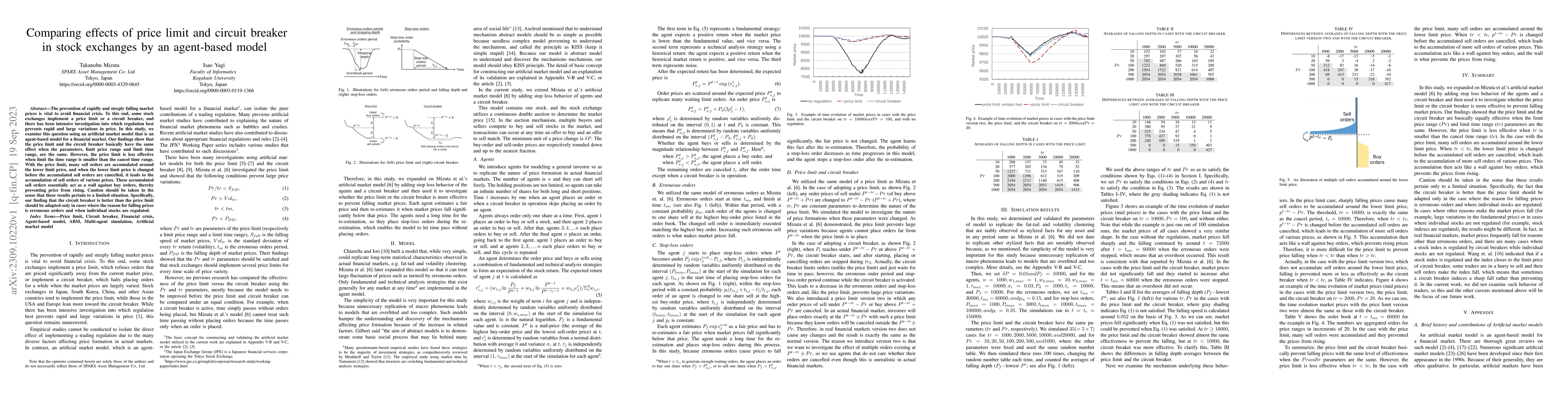

The prevention of rapidly and steeply falling market prices is vital to avoid financial crisis. To this end, some stock exchanges implement a price limit or a circuit breaker, and there has been intensive investigation into which regulation best prevents rapid and large variations in price. In this study, we examine this question using an artificial market model that is an agent-based model for a financial market. Our findings show that the price limit and the circuit breaker basically have the same effect when the parameters, limit price range and limit time range, are the same. However, the price limit is less effective when limit the time range is smaller than the cancel time range. With the price limit, many sell orders are accumulated around the lower limit price, and when the lower limit price is changed before the accumulated sell orders are cancelled, it leads to the accumulation of sell orders of various prices. These accumulated sell orders essentially act as a wall against buy orders, thereby preventing price from rising. Caution should be taken in the sense that these results pertain to a limited situation. Specifically, our finding that the circuit breaker is better than the price limit should be adapted only in cases where the reason for falling prices is erroneous orders and when individual stocks are regulated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)