Summary

This study investigates the impact of varying sequence lengths on the accuracy of predicting cryptocurrency returns using Artificial Neural Networks (ANNs). Utilizing the Mean Absolute Error (MAE) as a threshold criterion, we aim to enhance prediction accuracy by excluding returns that are smaller than this threshold, thus mitigating errors associated with minor returns. The subsequent evaluation focuses on the accuracy of predicted returns that exceed this threshold. We compare four sequence lengths 168 hours (7 days), 72 hours (3 days), 24 hours, and 12 hours each with a return prediction interval of 2 hours. Our findings reveal the influence of sequence length on prediction accuracy and underscore the potential for optimized sequence configurations in financial forecasting models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

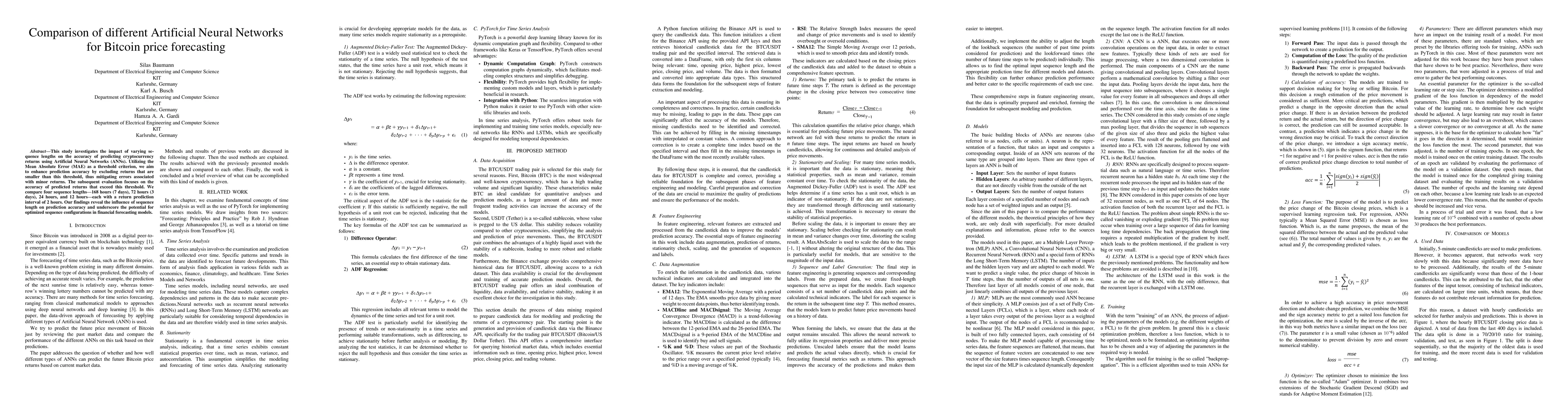

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Data-driven Deep Learning Approach for Bitcoin Price Forecasting

Abdelhak M. Zoubir, Parth Daxesh Modi, Kamyar Arshi et al.

Distributional neural networks for electricity price forecasting

Florian Ziel, Rafał Weron, Grzegorz Marcjasz et al.

No citations found for this paper.

Comments (0)