Summary

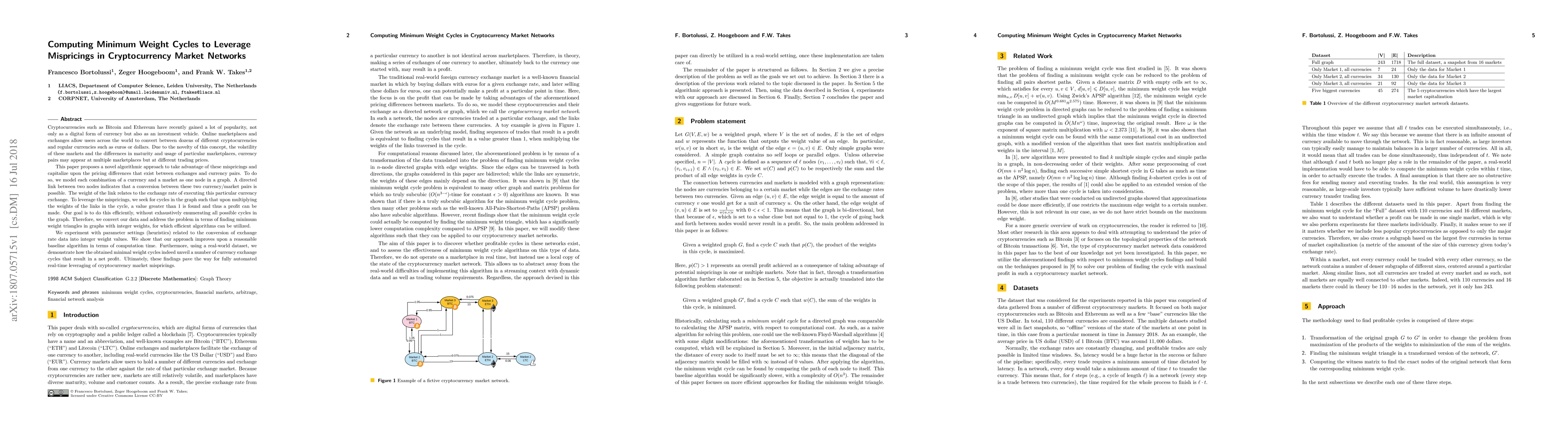

Cryptocurrencies such as Bitcoin and Ethereum have recently gained a lot of popularity, not only as a digital form of currency but also as an investment vehicle. Online marketplaces and exchanges allow users across the world to convert between dozens of different cryptocurrencies and regular currencies such as euros or dollars. Due to the novelty of this concept, the volatility of these markets and the differences in maturity and usage of particular marketplaces, currency pairs may appear at multiple marketplaces but at different trading prices. This paper proposes a novel algorithmic approach to take advantage of these mispricings and capitalize upon the pricing differences that exist between exchanges and currency pairs. To do so, we model each combination of a currency and a market as one node in a graph. A directed link between two nodes indicates that a conversion between these two currency/market pairs is possible. The weight of the link relates to the exchange rate of executing this particular currency exchange. To leverage the mispricings, we seek for cycles in the graph such that upon multiplying the weights of the links in the cycle, a value greater than 1 is found and thus a profit can be made. Our goal is to do this efficiently, without exhaustively enumerating all possible cycles in the graph. Therefore, we convert our data and address the problem in terms of finding minimum weight triangles in graphs with integer weights, for which efficient algorithms can be utilized. We experiment with parameter settings (heuristics) related to the conversion of exchange rate data into integer weight values. We show that our approach improves upon a reasonable baseline algorithm in terms of computation time. Furthermore, using a real-world dataset, we demonstrate how the obtained minimal weight cycles indeed unveil a number of currency exchange cycles that result in a net profit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)