Summary

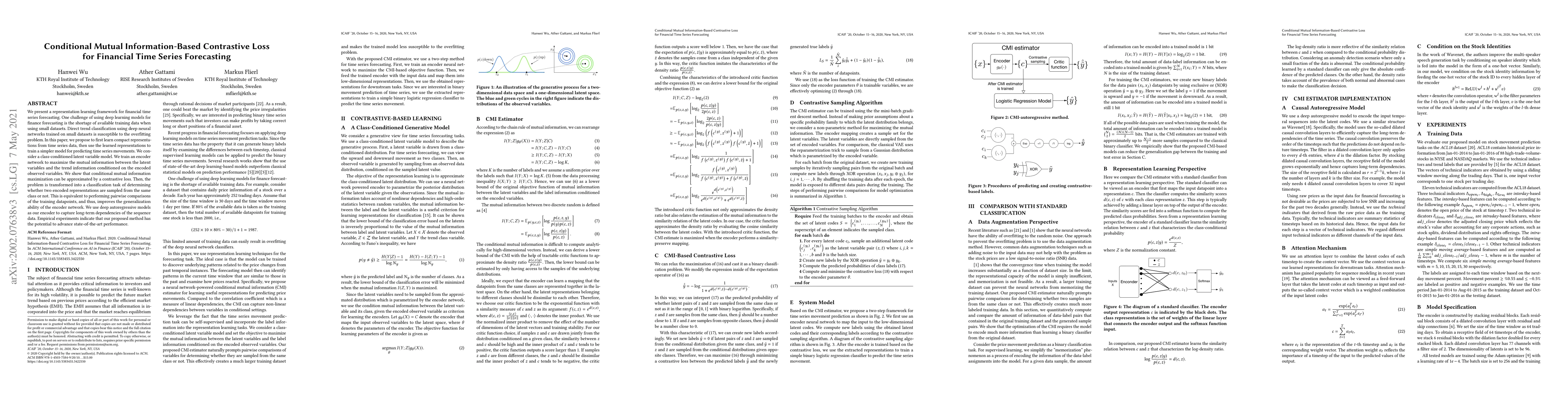

We present a representation learning framework for financial time series forecasting. One challenge of using deep learning models for finance forecasting is the shortage of available training data when using small datasets. Direct trend classification using deep neural networks trained on small datasets is susceptible to the overfitting problem. In this paper, we propose to first learn compact representations from time series data, then use the learned representations to train a simpler model for predicting time series movements. We consider a class-conditioned latent variable model. We train an encoder network to maximize the mutual information between the latent variables and the trend information conditioned on the encoded observed variables. We show that conditional mutual information maximization can be approximated by a contrastive loss. Then, the problem is transformed into a classification task of determining whether two encoded representations are sampled from the same class or not. This is equivalent to performing pairwise comparisons of the training datapoints, and thus, improves the generalization ability of the encoder network. We use deep autoregressive models as our encoder to capture long-term dependencies of the sequence data. Empirical experiments indicate that our proposed method has the potential to advance state-of-the-art performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersChannel-aware Contrastive Conditional Diffusion for Multivariate Probabilistic Time Series Forecasting

Hui Xiong, Yize Chen, Siyang Li

Large Language Models for Financial Aid in Financial Time-series Forecasting

Md Khairul Islam, Ayush Karmacharya, Judy Fox et al.

Modality-aware Transformer for Financial Time series Forecasting

Xuan-Hong Dang, Yousaf Shah, Petros Zerfos et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)