Authors

Summary

We propose an alternative linearization to the classical Markowitz quadratic portfolio optimization model, based on maximum drawdown. This model, which minimizes maximum portfolio drawdown, is particularly appealing during times of financial distress, like during the COVID-19 pandemic. In addition, we will present a Mixed-Integer Linear Programming variation of our new model that, based on our out-of-sample results and sensitivity analysis, delivers a more profitable and robust solution with a 200 times faster solving time compared to the standard Markowitz quadratic formulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

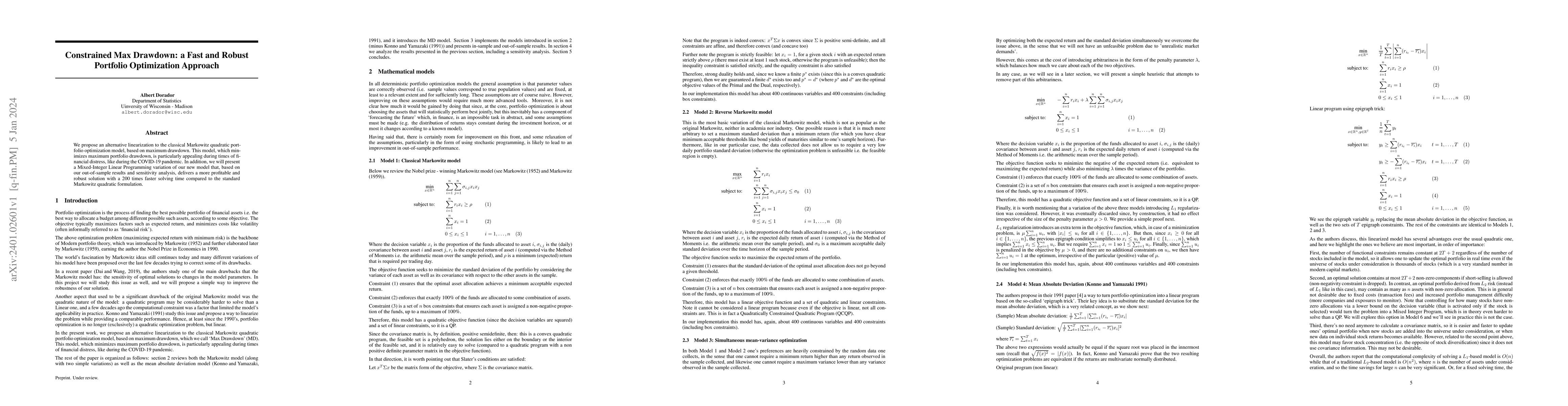

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCardinality-constrained Distributionally Robust Portfolio Optimization

Yuichi Takano, Ken Kobayashi, Kazuhide Nakata

No citations found for this paper.

Comments (0)