Authors

Summary

We investigate propagation of convexity and convex ordering on a typical stochastic optimal control problem, namely the pricing of \q{\emph{Take-or-Pay}} swing option, a financial derivative product commonly traded on energy markets. The dynamics of the underlying asset is modelled by an \emph{ARCH} model with convex coefficients. We prove that the value function associated to the stochastic optimal control problem is a convex function of the underlying asset price. We also introduce a domination criterion offering insights into the monotonicity of the value function with respect to parameters of the underlying \emph{ARCH} coefficients. We particularly focus on the one-dimensional setting where, by means of Stein's formula and regularization techniques, we show that the convexity assumption for the \emph{ARCH} coefficients can be relaxed with a semi-convexity assumption. To validate the results presented in this paper, we also conduct numerical illustrations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

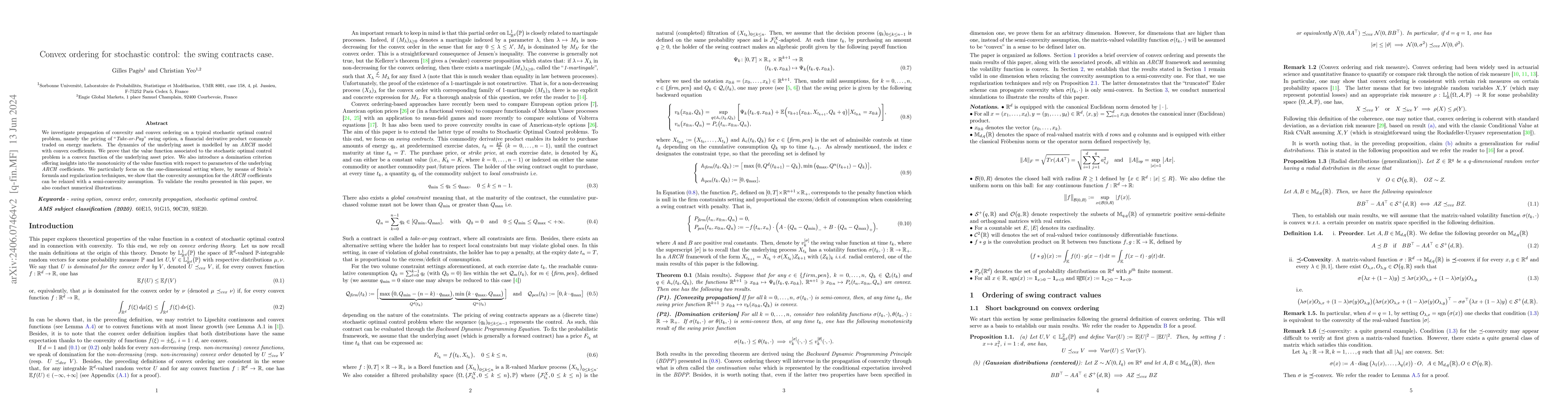

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvex ordering for stochastic Volterra equations and their Euler schemes

Gilles Pagès, Benjamin Jourdain

| Title | Authors | Year | Actions |

|---|

Comments (0)