Summary

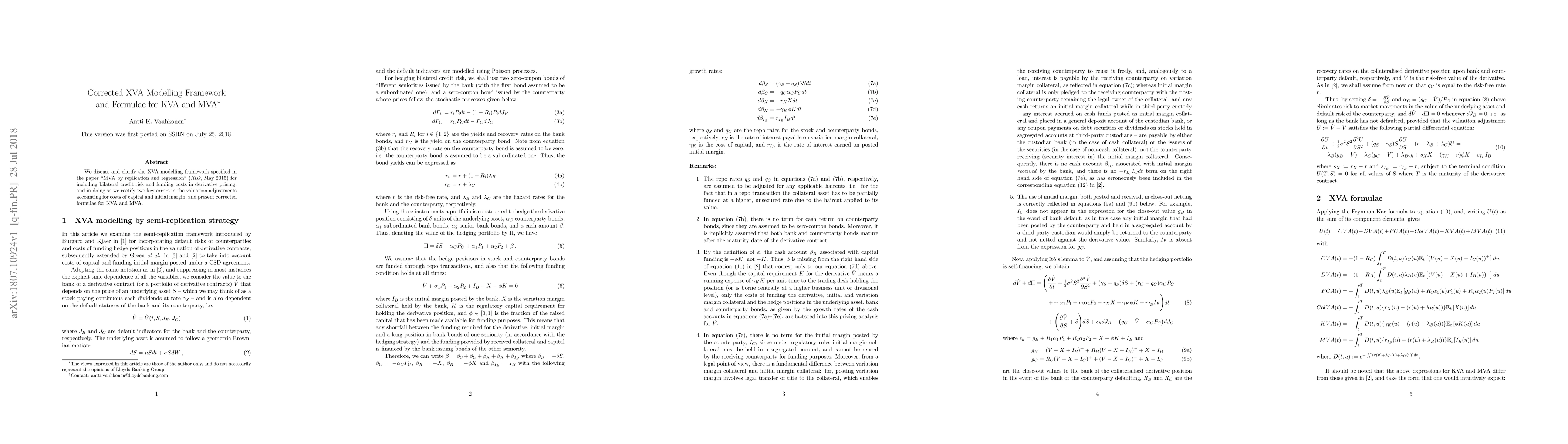

We discuss and clarify the XVA modelling framework specified in the paper "MVA by replication and regression" (Risk Magazine, May 2015) for including bilateral credit risk and funding costs in derivative pricing, and in doing so we rectify two key errors in the valuation adjustments accounting for costs of capital and initial margin, and present corrected formulae for KVA and MVA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMathematical models and numerical methods for a capital valuation adjustment (KVA) problem

C. Vázquez, D. Trevisani, J. G. López-Salas et al.

No citations found for this paper.

Comments (0)