Summary

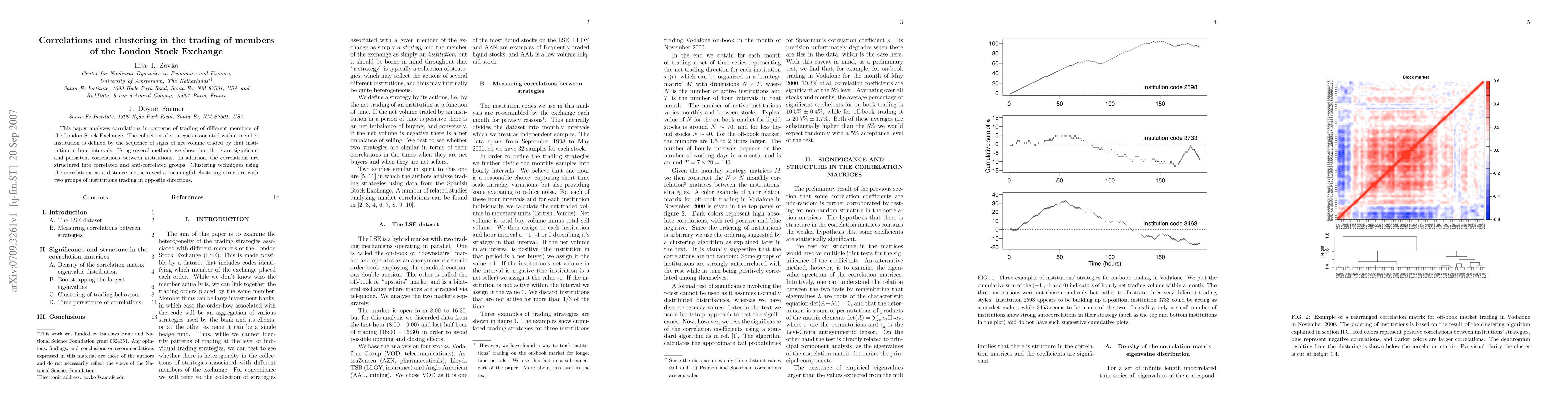

This paper analyzes correlations in patterns of trading of different members of the London Stock Exchange. The collection of strategies associated with a member institution is defined by the sequence of signs of net volume traded by that institution in hour intervals. Using several methods we show that there are significant and persistent correlations between institutions. In addition, the correlations are structured into correlated and anti-correlated groups. Clustering techniques using the correlations as a distance metric reveal a meaningful clustering structure with two groups of institutions trading in opposite directions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)