Summary

Predicting potential credit default accounts in advance is challenging. Traditional statistical techniques typically cannot handle large amounts of data and the dynamic nature of fraud and humans. To tackle this problem, recent research has focused on artificial and computational intelligence based approaches. In this work, we present and validate a heuristic approach to mine potential default accounts in advance where a risk probability is precomputed from all previous data and the risk probability for recent transactions are computed as soon they happen. Beside our heuristic approach, we also apply a recently proposed machine learning approach that has not been applied previously on our targeted dataset [15]. As a result, we find that these applied approaches outperform existing state-of-the-art approaches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

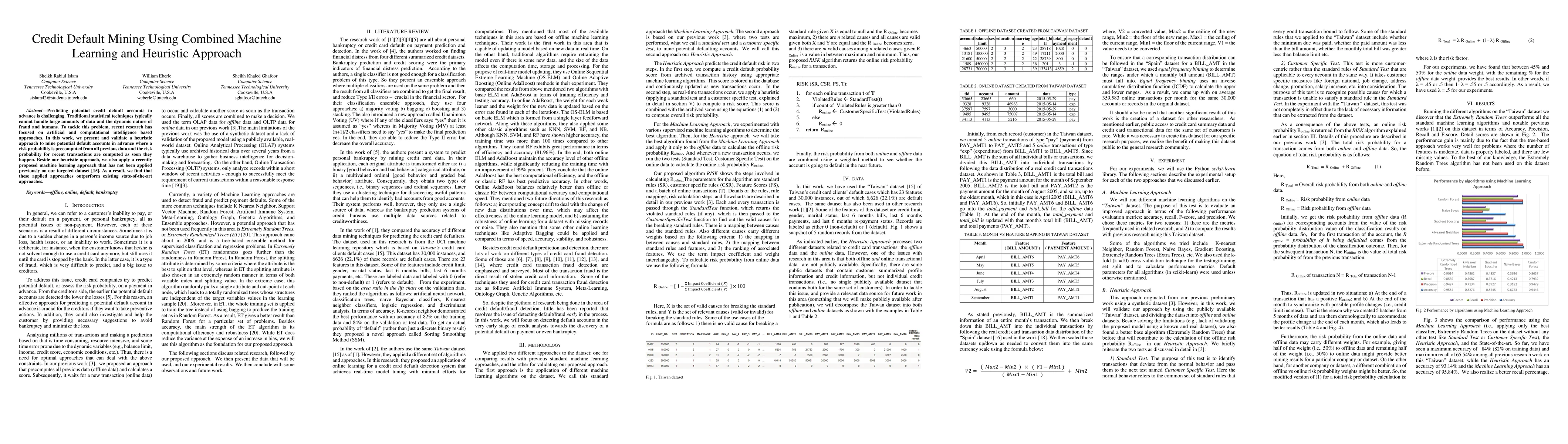

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA machine learning workflow to address credit default prediction

Rambod Rahmani, Marco Parola, Mario G. C. A. Cimino

A Spatio-Temporal Machine Learning Model for Mortgage Credit Risk: Default Probabilities and Loan Portfolios

Fabio Sigrist, Pascal Kündig

Interpretable Credit Default Prediction with Ensemble Learning and SHAP

Shiqi Yang, Xinyu Shen, Ziyi Huang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)