Summary

Due to the recent increase in interest in Financial Technology (FinTech), applications like credit default prediction (CDP) are gaining significant industrial and academic attention. In this regard, CDP plays a crucial role in assessing the creditworthiness of individuals and businesses, enabling lenders to make informed decisions regarding loan approvals and risk management. In this paper, we propose a workflow-based approach to improve CDP, which refers to the task of assessing the probability that a borrower will default on his or her credit obligations. The workflow consists of multiple steps, each designed to leverage the strengths of different techniques featured in machine learning pipelines and, thus best solve the CDP task. We employ a comprehensive and systematic approach starting with data preprocessing using Weight of Evidence encoding, a technique that ensures in a single-shot data scaling by removing outliers, handling missing values, and making data uniform for models working with different data types. Next, we train several families of learning models, introducing ensemble techniques to build more robust models and hyperparameter optimization via multi-objective genetic algorithms to consider both predictive accuracy and financial aspects. Our research aims at contributing to the FinTech industry in providing a tool to move toward more accurate and reliable credit risk assessment, benefiting both lenders and borrowers.

AI Key Findings

Generated Sep 03, 2025

Methodology

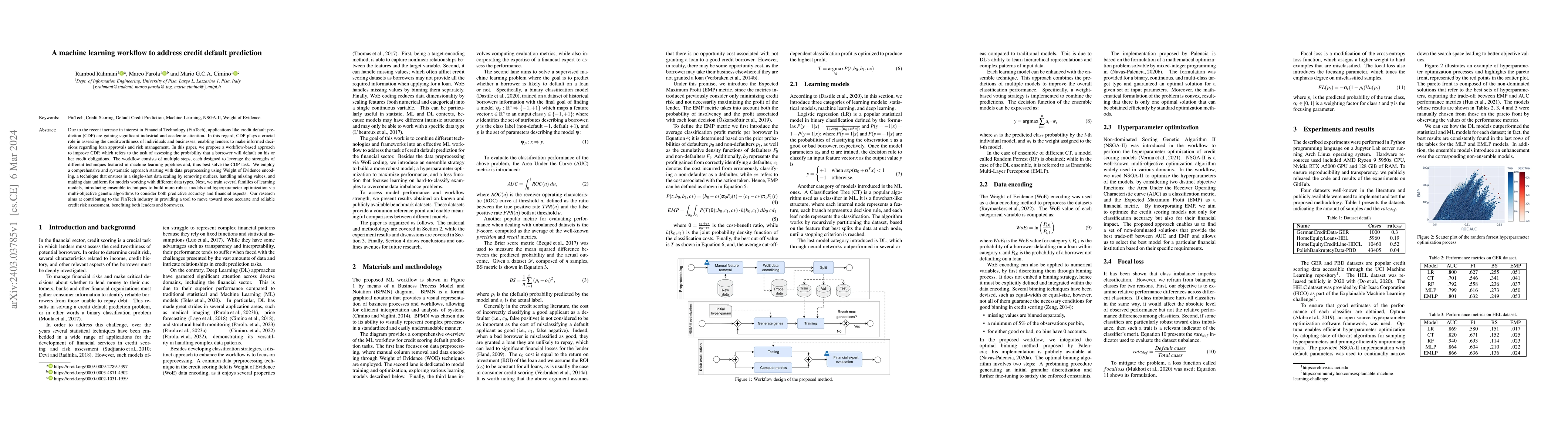

The paper proposes a machine learning workflow for credit default prediction, utilizing Weight of Evidence (WoE) encoding, various learning models (statistical, machine learning, and deep learning), ensemble techniques, and hyperparameter optimization via multi-objective genetic algorithms.

Key Results

- The proposed workflow outperformed traditional models by combining WoE-based preprocessing, ensemble strategies, and NSGA-II hyperparameter optimization.

- Deep learning models (MLP and EMLP) consistently achieved the best results across different datasets, surpassing statistical and machine learning models.

- Ensemble models (RF and EMLP) enhanced performance over their corresponding non-ensemble counterparts.

Significance

This research contributes to the FinTech industry by providing a more accurate and reliable credit risk assessment tool, benefiting both lenders and borrowers.

Technical Contribution

The paper introduces a novel machine learning workflow that combines WoE-based preprocessing, ensemble strategies, and NSGA-II hyperparameter optimization for credit default prediction.

Novelty

This work differentiates itself by integrating WoE encoding, multi-objective genetic algorithms, and deep learning models within a comprehensive workflow for credit risk assessment.

Limitations

- The study did not address class imbalance by balancing classes, focusing instead on relative performance differences among classifiers.

- The applicability of the approach in real-world scenarios was not directly demonstrated through integration with enterprise software systems.

Future Work

- Explore the applicability of the approach in real-world scenarios by integrating classification models into enterprise software systems.

- Investigate the potential of extending this approach to corporate credit scoring, beyond customer-level assessments.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKACDP: A Highly Interpretable Credit Default Prediction Model

Jin Zhao, Kun Liu

Interpretable Credit Default Prediction with Ensemble Learning and SHAP

Shiqi Yang, Xinyu Shen, Ziyi Huang et al.

Credit Default Prediction with Projected Quantum Feature Models and Ensembles

Mariana LaDue, Sutapa Samanta, Amol Deshmukh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)