Authors

Summary

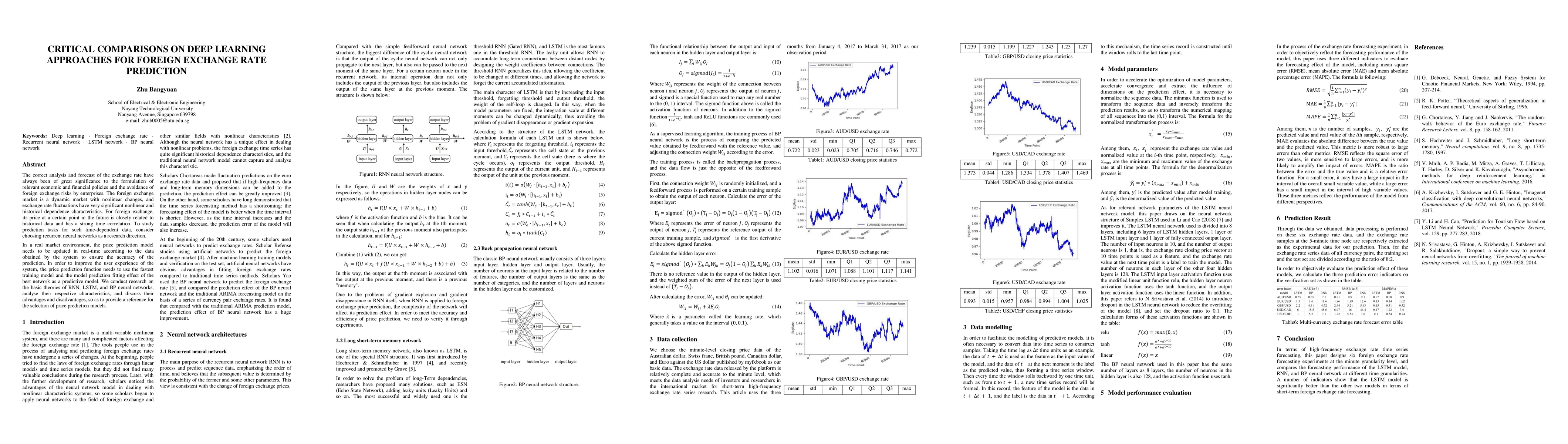

In a natural market environment, the price prediction model needs to be updated in real time according to the data obtained by the system to ensure the accuracy of the prediction. In order to improve the user experience of the system, the price prediction function needs to use the fastest training model and the model prediction fitting effect of the best network as a predictive model. We conduct research on the fundamental theories of RNN, LSTM, and BP neural networks, analyse their respective characteristics, and discuss their advantages and disadvantages to provide a reference for the selection of price-prediction models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)