Authors

Summary

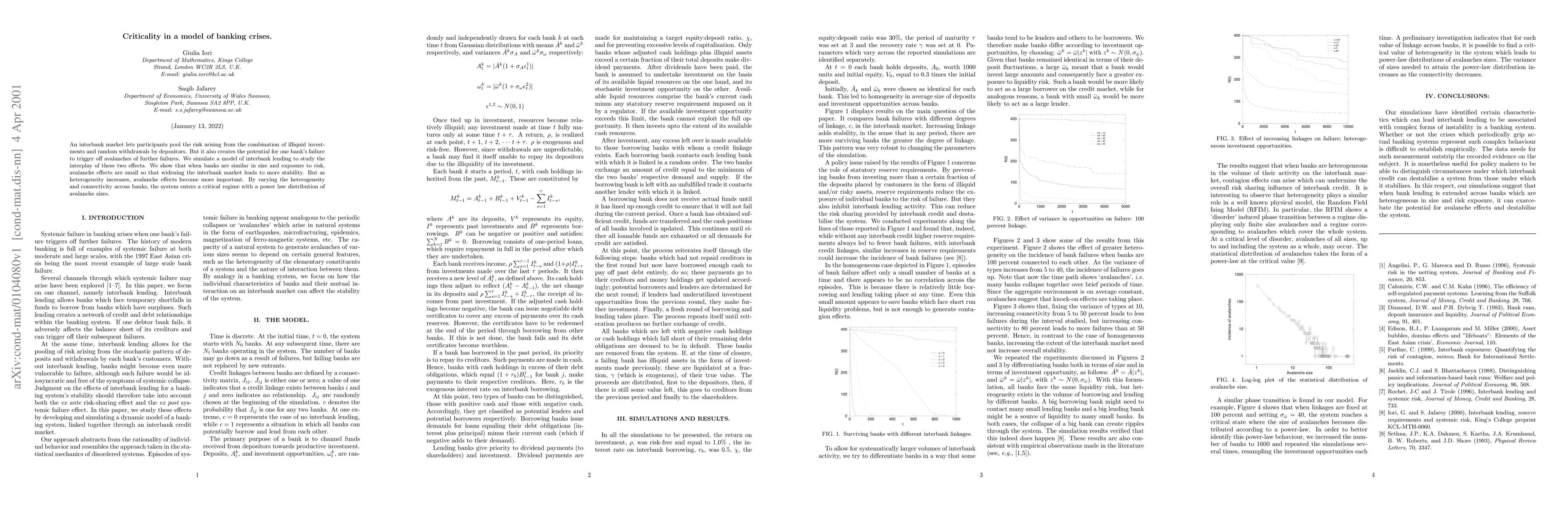

An interbank market lets participants pool the risk arising from the combination of illiquid investments and random withdrawals by depositors. But it also creates the potential for one bank's failure to trigger off avalanches of further failures. We simulate a model of interbank lending to study the interplay of these two effects. We show that when banks are similar in size and exposure to risk, avalanche effects are small so that widening the interbank market leads to more stability. But as heterogeneity increases, avalanche effects become more important. By varying the heterogeneity and connectivity across banks, the system enters a critical regime with a power law distribution of avalanche sizes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)