Summary

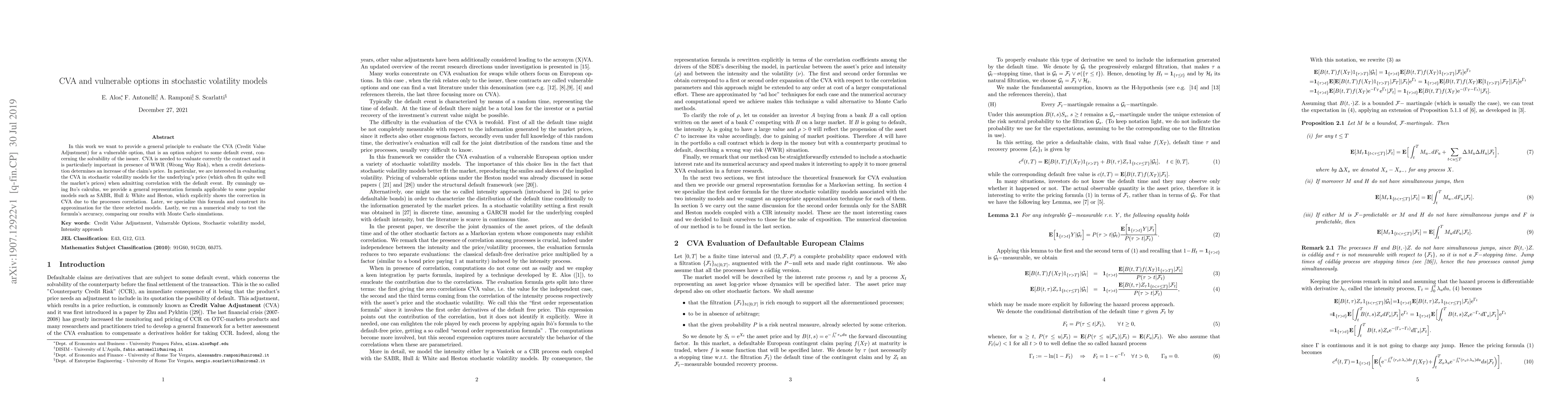

In this work we want to provide a general principle to evaluate the CVA (Credit Value Adjustment) for a vulnerable option, that is an option subject to some default event, concerning the solvability of the issuer. CVA is needed to evaluate correctly the contract and it is particularly important in presence of WWR (Wrong Way Risk), when a credit deterioration determines an increase of the claim's price. In particular, we are interested in evaluating the CVA in stochastic volatility models for the underlying's price (which often fit quite well the market's prices) when admitting correlation with the default event. By cunningly using Ito's calculus, we provide a general representation formula applicable to some popular models such as SABR, Hull \& White and Heston, which explicitly shows the correction in CVA due to the processes correlation. Later, we specialize this formula and construct its approximation for the three selected models. Lastly, we run a numerical study to test the formula's accuracy, comparing our results with Monte Carlo simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCVA in fractional and rough volatility models

Sergio Scarlatti, Elisa Alòs, Alessandro Ramponi et al.

Short-maturity Asian options in local-stochastic volatility models

Dan Pirjol, Lingjiong Zhu

Short-maturity asymptotics for VIX and European options in local-stochastic volatility models

Xiaoyu Wang, Dan Pirjol, Lingjiong Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)