Summary

In this work we present a general representation formula for the price of a vulnerable European option, and the related CVA in stochastic (either rough or not) volatility models for the underlying's price, when admitting correlation with the default event. We specialize it for some volatility models and we provide price approximations, based on the representation formula. We study numerically their accuracy, comparing the results with Monte Carlo simulations, and we run a theoretical study of the error. We also introduce a seminal study of roughness influence on the claim's price.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

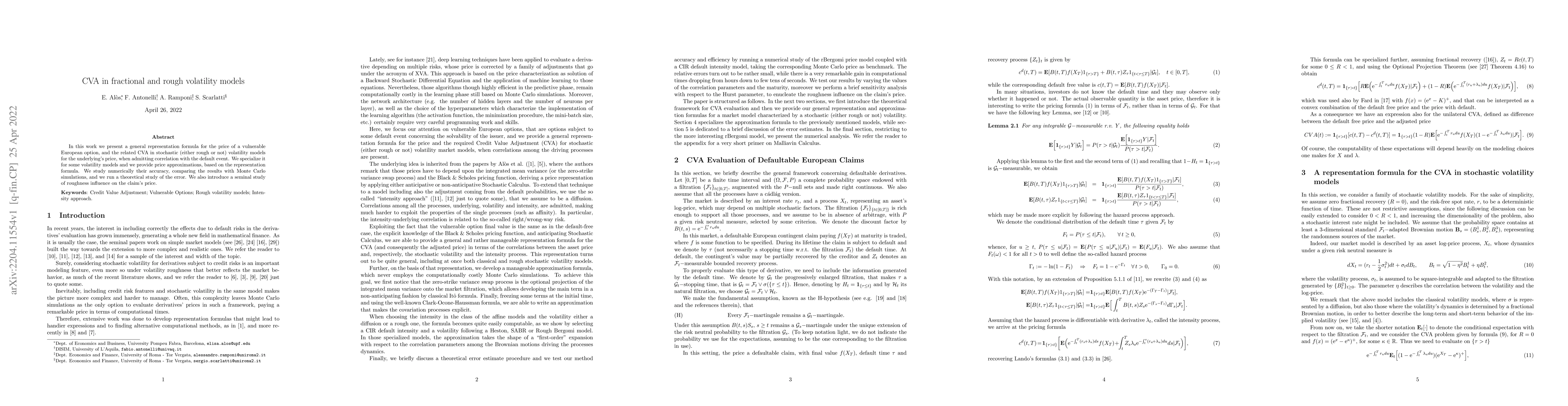

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)