Summary

We consider the problem of computing the Credit Value Adjustment ({CVA}) of a European option in presence of the Wrong Way Risk ({WWR}) in a default intensity setting. Namely we model the asset price evolution as solution to a linear equation that might depend on different stochastic factors and we provide an approximate evaluation of the option's price, by exploiting a correlation expansion approach, introduced in \cite{AS}. We compare the numerical performance of such a method with that recently proposed by Brigo et al. (\cite{BR18}, \cite{BRH18}) in the case of a call option driven by a GBM correlated with the CIR default intensity. We additionally report some numerical evaluations obtained by other methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

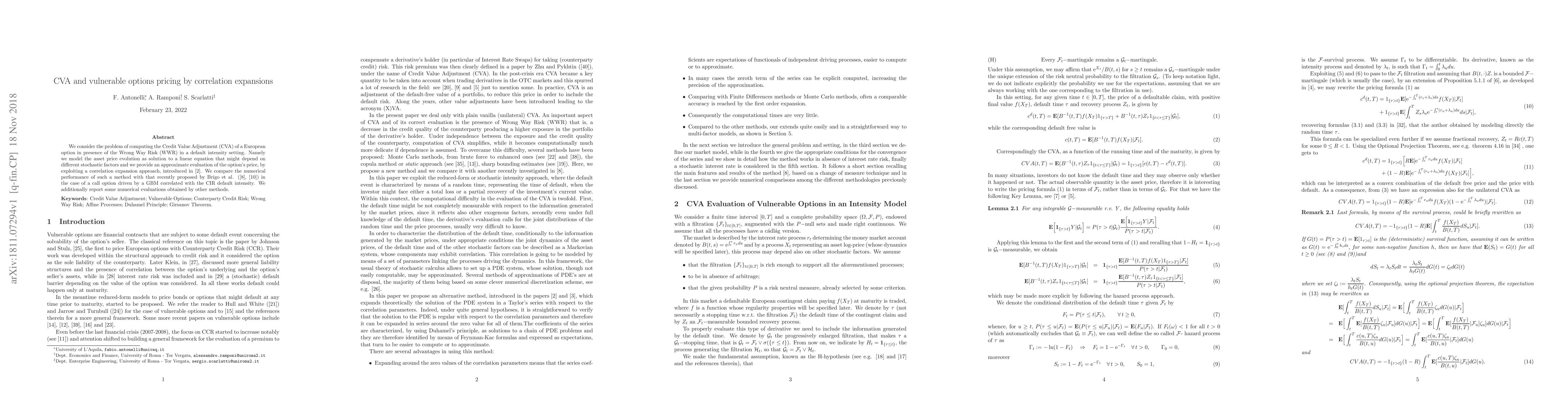

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)