Authors

Summary

This paper introduces a new approach to generating sample paths of unknown stochastic differential equations (SDEs) using diffusion models, a class of generative AI models commonly employed in image and video applications. Unlike the traditional Monte Carlo methods for simulating SDEs, which require explicit specifications of the drift and diffusion coefficients, our method takes a model-free, data-driven approach. Given a finite set of sample paths from an SDE, we utilize conditional diffusion models to generate new, synthetic paths of the same SDE. To demonstrate the effectiveness of our approach, we conduct a simulation experiment to compare our method with alternative benchmark ones including neural SDEs. Furthermore, in an empirical study we leverage these synthetically generated sample paths to enhance the performance of reinforcement learning algorithms for continuous-time mean-variance portfolio selection, hinting promising applications of diffusion models in financial analysis and decision-making.

AI Key Findings

Generated Nov 02, 2025

Methodology

The paper introduces a data-driven approach using conditional diffusion models to generate sample paths of unknown stochastic differential equations (SDEs). Unlike traditional Monte Carlo methods, it leverages finite sample paths to train diffusion models that simulate stochastic increments of SDEs.

Key Results

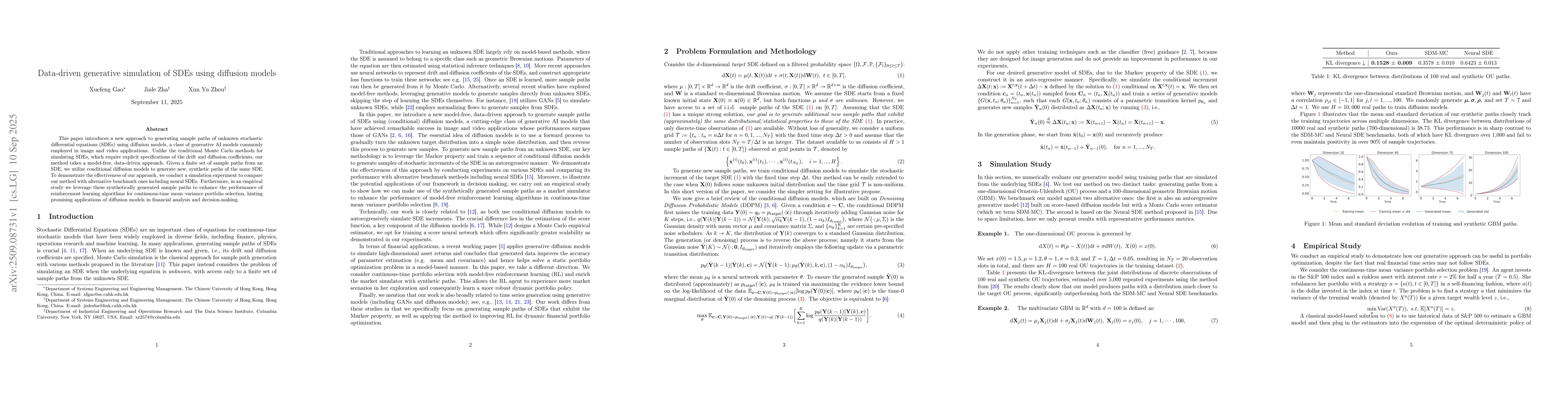

- The proposed method outperforms SDM-MC and Neural SDE benchmarks in generating OU process paths with significantly lower KL divergence.

- For the 100-dimensional geometric Brownian motion, the synthetic paths closely match training trajectories across dimensions with a KL divergence of 38.73.

- The inclusion of synthetic paths in reinforcement learning improves the Sharpe ratio of portfolio strategies, demonstrating practical financial applications.

Significance

This research bridges generative AI with financial modeling, offering a novel way to simulate SDEs without explicit drift/diffusion coefficients. Its applications in portfolio optimization highlight potential for improved decision-making in financial analysis.

Technical Contribution

Development of conditional diffusion models for SDE simulation, with a focus on auto-regressive generation of stochastic increments using neural networks.

Novelty

The work introduces a model-free, data-driven approach to SDE simulation using diffusion models, differing from traditional Monte Carlo methods and neural SDE approaches.

Limitations

- The method assumes uniform time grids and fixed initial conditions, limiting generality.

- Performance evaluation is based on synthetic data, which may not fully reflect real-world financial market complexities.

Future Work

- Extending to non-uniform time grids and unknown initial distributions.

- Exploring applications in more complex financial instruments and market scenarios.

Paper Details

PDF Preview

Similar Papers

Found 4 papersQuantum-Noise-Driven Generative Diffusion Models

Stefano Martina, Filippo Caruso, Marco Parigi

DomainStudio: Fine-Tuning Diffusion Models for Domain-Driven Image Generation using Limited Data

Jiansheng Chen, Jian Yuan, Huimin Ma et al.

Comments (0)