Summary

In this paper, we consider a new problem of portfolio optimization using stochastic information. In a setting where there is some uncertainty, we ask how to best select $k$ potential solutions, with the goal of optimizing the value of the best solution. More formally, given a combinatorial problem $\Pi$, a set of value functions $V$ over the solutions of $\Pi$, and a distribution $D$ over $V$, our goal is to select $k$ solutions of $\Pi$ that maximize or minimize the expected value of the {\em best} of those solutions. For a simple example, consider the classic knapsack problem: given a universe of elements each with unit weight and a positive value, the task is to select $r$ elements maximizing the total value. Now suppose that each element's weight comes from a (known) distribution. How should we select $k$ different solutions so that one of them is likely to yield a high value? In this work, we tackle this basic problem, and generalize it to the setting where the underlying set system forms a matroid. On the technical side, it is clear that the candidate solutions we select must be diverse and anti-correlated; however, it is not clear how to do so efficiently. Our main result is a polynomial-time algorithm that constructs a portfolio within a constant factor of the optimal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

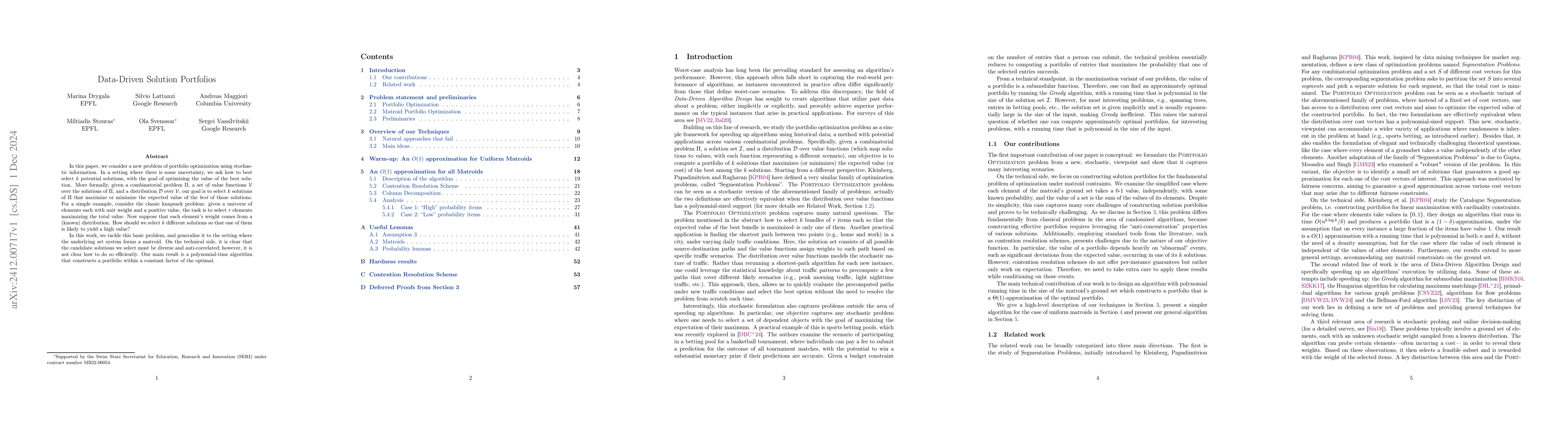

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWasserstein-Kelly Portfolios: A Robust Data-Driven Solution to Optimize Portfolio Growth

Jonathan Yu-Meng Li

Data-driven integration of norm-penalized mean-variance portfolios

Andrew Butler, Roy H. Kwon

No citations found for this paper.

Comments (0)