Authors

Summary

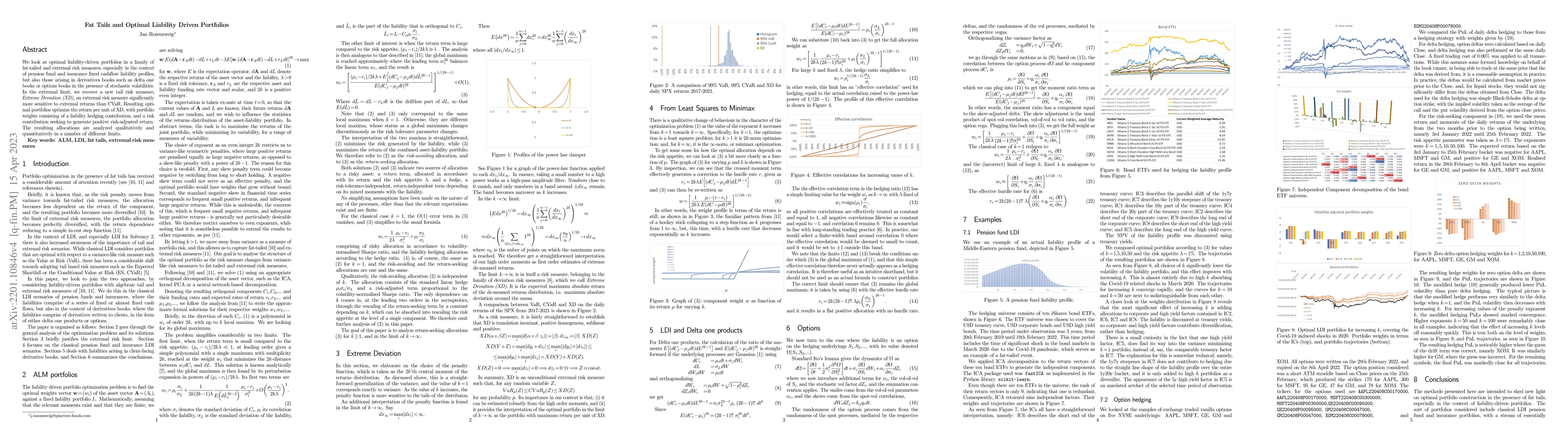

We look at optimal liability-driven portfolios in a family of fat-tailed and extremal risk measures, especially in the context of pension fund and insurance fixed cashflow liability profiles, but also those arising in derivatives books such as delta one books or options books in the presence of stochastic volatilities. In the extremal limit, we recover a new tail risk measure, Extreme Deviation (XD), an extremal risk measure significantly more sensitive to extremal returns than CVaR. Resulting optimal portfolios optimize the return per unit of XD, with portfolio weights consisting of a liability hedging contribution, and a risk contribution seeking to generate positive risk-adjusted return. The resulting allocations are analyzed qualitatively and quantitatively in a number of different limits.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)