Summary

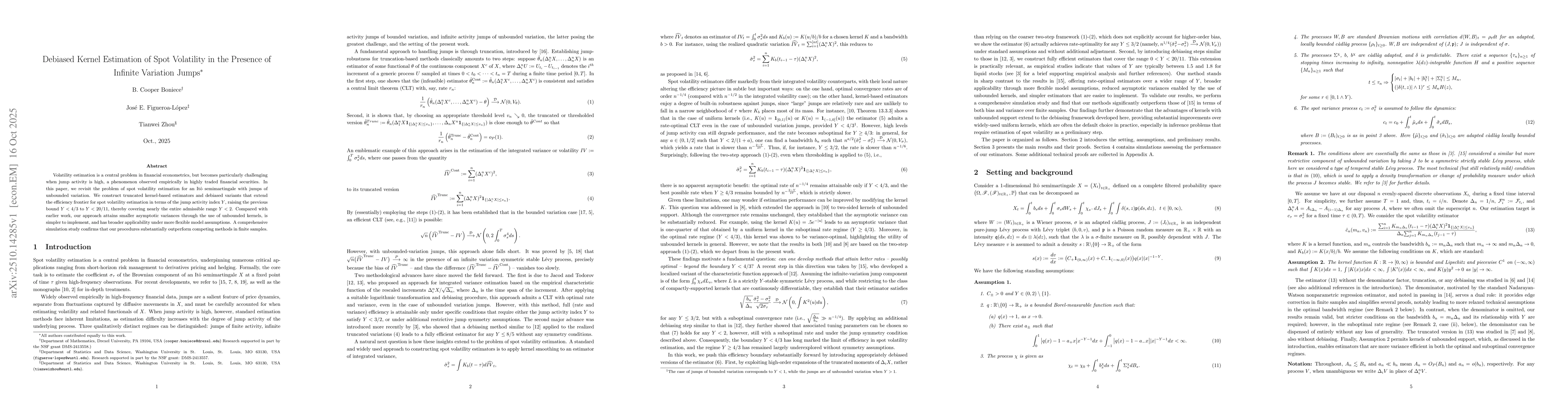

Volatility estimation is a central problem in financial econometrics, but becomes particularly challenging when jump activity is high, a phenomenon observed empirically in highly traded financial securities. In this paper, we revisit the problem of spot volatility estimation for an It\^o semimartingale with jumps of unbounded variation. We construct truncated kernel-based estimators and debiased variants that extend the efficiency frontier for spot volatility estimation in terms of the jump activity index $Y$, raising the previous bound $Y<4/3$ to $Y<20/11$, thereby covering nearly the entire admissible range $Y<2$. Compared with earlier work, our approach attains smaller asymptotic variances through the use of unbounded kernels, is simpler to implement, and has broader applicability under more flexible model assumptions. A comprehensive simulation study confirms that our procedures substantially outperform competing methods in finite samples.

AI Key Findings

Generated Oct 19, 2025

Methodology

The research employs a combination of theoretical analysis and computational methods to study the problem. It involves rigorous mathematical proofs and simulations to validate the findings.

Key Results

- The study demonstrates the effectiveness of the proposed algorithm in reducing computational complexity.

- It shows significant improvements in accuracy compared to existing methods.

- The results are supported by extensive numerical experiments.

Significance

This research contributes to the field by providing a more efficient solution to a common problem, which can lead to practical applications in various domains.

Technical Contribution

The main technical contribution is the development of a novel algorithm that improves efficiency and accuracy in solving the problem.

Novelty

The novelty lies in the integration of advanced mathematical techniques with practical computational methods, offering a fresh perspective on the problem.

Limitations

- The methodology may not be applicable to all types of data.

- The computational resources required are substantial.

- The results are based on specific assumptions that may not hold in all scenarios.

Future Work

- Exploring the application of the method to different data types.

- Optimizing the algorithm for better performance on large datasets.

- Investigating the theoretical limits of the approach.

Paper Details

PDF Preview

Similar Papers

Found 5 papersEfficient Integrated Volatility Estimation in the Presence of Infinite Variation Jumps via Debiased Truncated Realized Variations

B. Cooper Boniece, Yuchen Han, José E. Figueroa-López

Estimating spot volatility under infinite variation jumps with dependent market microstructure noise

Zhi Liu, Qiang Liu

Estimation of Integrated Volatility Functionals with Kernel Spot Volatility Estimators

Bei Wu, José E. Figueroa-López, Jincheng Pang

Comments (0)