Authors

Summary

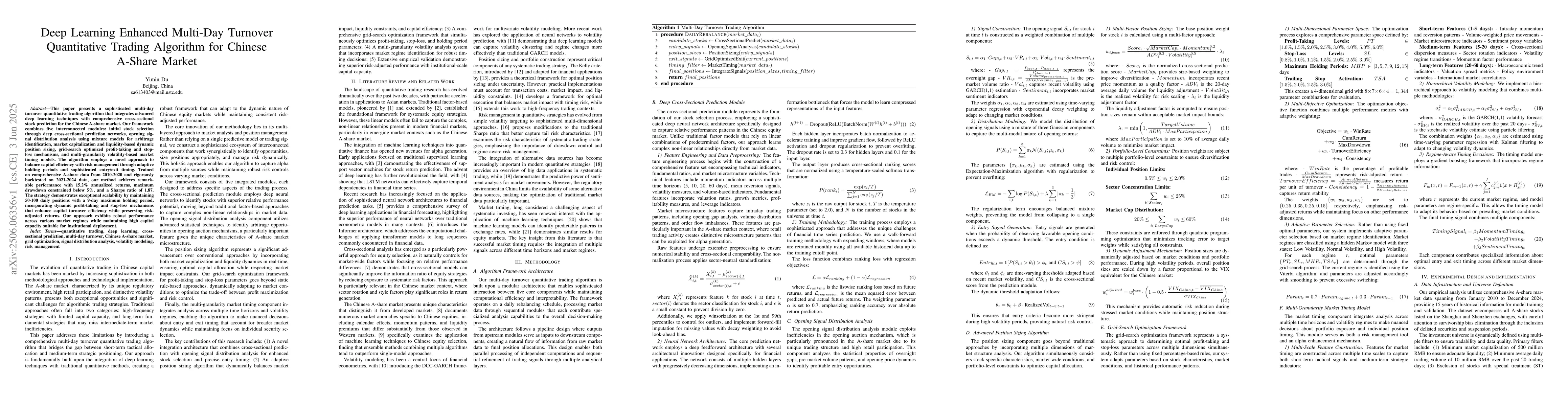

This paper presents a sophisticated multi-day turnover quantitative trading algorithm that integrates advanced deep learning techniques with comprehensive cross-sectional stock prediction for the Chinese A-share market. Our framework combines five interconnected modules: initial stock selection through deep cross-sectional prediction networks, opening signal distribution analysis using mixture models for arbitrage identification, market capitalization and liquidity-based dynamic position sizing, grid-search optimized profit-taking and stop-loss mechanisms, and multi-granularity volatility-based market timing models. The algorithm employs a novel approach to balance capital efficiency with risk management through adaptive holding periods and sophisticated entry/exit timing. Trained on comprehensive A-share data from 2010-2020 and rigorously backtested on 2021-2024 data, our method achieves remarkable performance with 15.2\% annualized returns, maximum drawdown constrained below 5\%, and a Sharpe ratio of 1.87. The strategy demonstrates exceptional scalability by maintaining 50-100 daily positions with a 9-day maximum holding period, incorporating dynamic profit-taking and stop-loss mechanisms that enhance capital turnover efficiency while preserving risk-adjusted returns. Our approach exhibits robust performance across various market regimes while maintaining high capital capacity suitable for institutional deployment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Quantitative Trading

Jiawei Du, Zheng Tao, Zixun Lan et al.

A Deep Reinforcement Learning Approach for Trading Optimization in the Forex Market with Multi-Agent Asynchronous Distribution

Davoud Sarani, Dr. Parviz Rashidi-Khazaee

No citations found for this paper.

Comments (0)