Summary

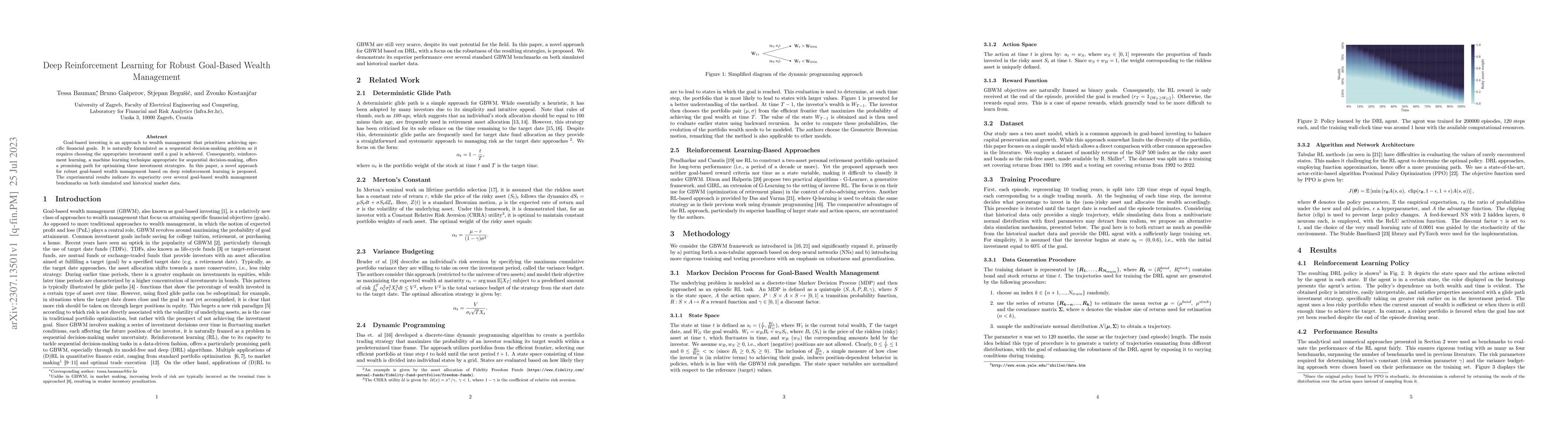

Goal-based investing is an approach to wealth management that prioritizes achieving specific financial goals. It is naturally formulated as a sequential decision-making problem as it requires choosing the appropriate investment until a goal is achieved. Consequently, reinforcement learning, a machine learning technique appropriate for sequential decision-making, offers a promising path for optimizing these investment strategies. In this paper, a novel approach for robust goal-based wealth management based on deep reinforcement learning is proposed. The experimental results indicate its superiority over several goal-based wealth management benchmarks on both simulated and historical market data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)