Authors

Summary

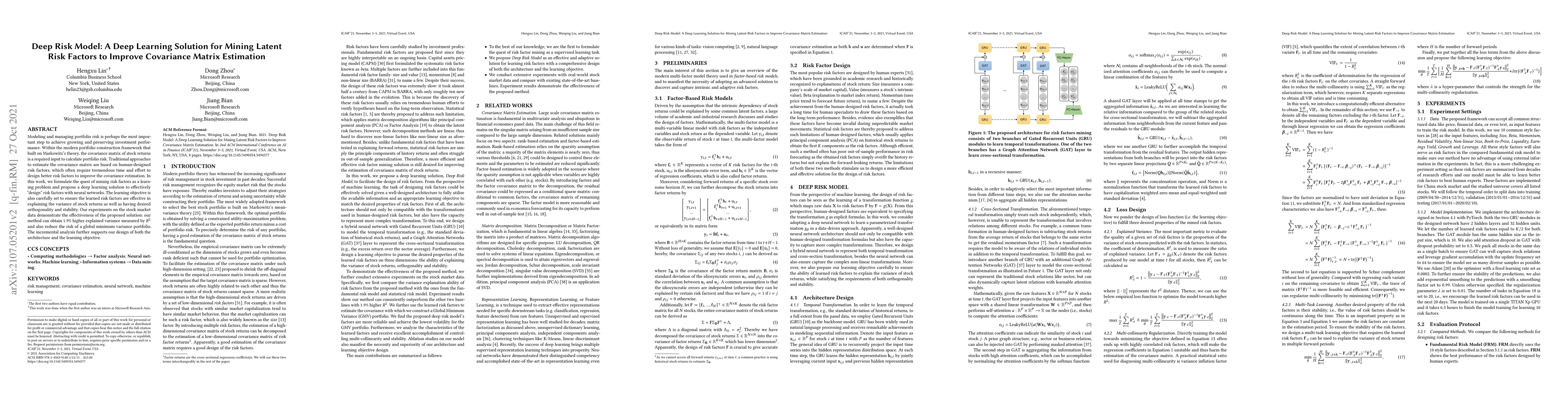

Modeling and managing portfolio risk is perhaps the most important step to achieve growing and preserving investment performance. Within the modern portfolio construction framework that built on Markowitz's theory, the covariance matrix of stock returns is a required input to calculate portfolio risk. Traditional approaches to estimate the covariance matrix are based on human-designed risk factors, which often require tremendous time and effort to design better risk factors to improve the covariance estimation. In this work, we formulate the quest of mining risk factors as a learning problem and propose a deep learning solution to effectively ``design'' risk factors with neural networks. The learning objective is also carefully set to ensure the learned risk factors are effective in explaining the variance of stock returns as well as having desired orthogonality and stability. Our experiments on the stock market data demonstrate the effectiveness of the proposed solution: our method can obtain $1.9\%$ higher explained variance measured by $R^2$ and also reduce the risk of a global minimum variance portfolio. The incremental analysis further supports our design of both the architecture and the learning objective.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning for Systemic Risk Measures

Jean-Pierre Fouque, Yichen Feng, Ming Min

Deep Learning Based Channel Covariance Matrix Estimation with User Location and Scene Images

Weihua Xu, Jianhua Zhang, Feifei Gao et al.

A Transformer-Based Deep Learning Approach for Fairly Predicting Post-Liver Transplant Risk Factors

Kai Zhang, Xiaoqian Jiang, Can Li

| Title | Authors | Year | Actions |

|---|

Comments (0)